After three week under Israeli siege and a bombing campaign which has been unprecedented in its intensity, Gazans are getting increasingly desperate. The Strip is almost completely enveloped in darkness, also with communications cut, which happened Friday, and the United Nations is now warning of a total breakdown in civic order.

UN Relief and Works Agency for Palestine Refugees (UNRWA) in Gaza has said that thousands of Palestinians have broken into several of its warehouses in the Strip, raiding wheat, flour, and hygiene stores - among other basic necessities stored there.

"This is a worrying sign that civil order is starting to break down after three weeks of war and a tight siege,” UNRWA director Thomas White told press agencies.

UN Secretary-General Antonio Guterres has also in fresh Sunday statements called the crisis a "nightmare" and again urged a ceasefire. "The situation in Gaza is growing more desperate by the hour. I regret that instead of a critically needed humanitarian pause, supported by the international community, Israel has intensified its military operations."

Over the weekend the Gazan death toll surpassed 8,000 - with Gaza's Health Ministry saying that most of these are women and young people. The Biden administration, which has repeatedly affirmed that it "stands with Israel", has also said that it doesn't trust casualty figures being issued by Hamas or Palestinian sources.

There are reports that communications were restored to much of the Gaza Strip as of Sunday, possibly the result of growing international pressure on the Israelis. Ten more aid trucks have also reportedly crossed from Egypt on Sunday.

According to Al Jazeera, "The Israeli military said on Sunday it had struck more than 450 targets over the past 24 hours, including Hamas command centres, observation posts and antitank missile launching positions. It said more ground forces were sent into Gaza overnight." The Israeli ground offensive has continued expanding, with The Guardian observing, "Under the cover of strikes and artillery, Israeli ground troops have begun moving into the north of the strip in Beit Lahia and Beit Hanoun in what the Israeli prime minister, Benjamin Netanyahu, described as the “second stage” of the war triggered by Hamas."

As we continue to expand our ground operations in northern Gaza:

— Israel Defense Forces (@IDF) October 29, 2023

🔴IAF aircraft, guided by IDF troops, struck Hamas structures.

🔴Anti-tank missile launch posts & observation posts were struck.

🔴Multiple terrorists were eliminated. pic.twitter.com/XMwKPKGZ1R

IDF troops have been seen reaching a point some two miles into Gaza:

Israeli troops appear to have advanced over two miles into Gaza, according to a CNN analysis of video published by an Israeli media outlet.

The troops in the video, taken on Saturday, are seen putting an Israeli flag on a Gaza resort hotel's roof. CNN geolocated the video to an area just over two miles from the Gaza-Israeli border.

"Soldiers of the 52 Battalion of the 401 Brigade are waving the Israeli flag in the heart of Gaza, by the beach," a soldier is heard saying in the video, taken several miles north of central Gaza City. "We will not forgive nor forget, and we’ll not stop until the victory."

Palestinian sources are also saying another major hospital, which is treating hundreds of patients and giving shelter to over 10,000, has come under attack:

Israeli airstrikes have “caused extensive damage to hospital departments and exposed residents and patients to suffocation” at the Al-Quds Hospital, the Palestinian Red Crescent Society said Sunday.

The aid organization accused Israel of “deliberately” launching the airstrikes “directly next to Al-Quds Hospital, with the aim of forcing the medical staff, displaced people, and patients to evacuate the hospital.”

Major bulldozing and tank operations have been observed on the beach in Gaza...

Israeli Defence Forces over the last few hours continued to strike and kill terrorists in the Gaza Strip. IDF soldiers operating adjacent to the Erez Crossing identified a number of terrorists exiting the shaft of a tunnel in the Gaza Strip. Following the identification, the… pic.twitter.com/EKGA69Vvdo

— Aditya Raj Kaul (@AdityaRajKaul) October 29, 2023

A statement cited in The Times of Israel described:

The IDF says troops killed a number of Hamas gunmen who opened fire at the ground forces in the Strip, and other terrorists identified on the beach in Gaza, near the southern Israel community of Zikim.

Hamas and the IDF have continued to exchange gunfire, but the status of forces on either said remains unknown and for the moment lost in the fog of war. At this point, if either suffers significant casualties, they are unlikely to make it publicly known.

Meanwhile, the intensifying crisis for Palestinian civilians has not only led to massive street protests in various nations, particularly in Europe, but has resulted in rare criticism aimed at Israel from leading Western nations. The French government has issued scathing criticism of "unacceptable" Israeli settler attacks on Palestinians in the West Bank:

More than 100 Palestinians have been killed in the West Bank since the outbreak of war in the Gaza Strip earlier this month, mostly during raids by Israeli forces or attacks by settlers, according to the Ramallah-based health ministry.

“France strongly condemns the settler attacks that have led to the deaths of several Palestinian civilians over the past few days in Qusra and Sawiya, as well as the forced departure of several communities,” said a foreign ministry statement.

And Norway too has condemned what it says is a massive and "disproportionate" response and death toll among Palestinians in the wake of the Oct.7 Hamas terror attack which killed 1,400 people. "International law stipulates that [the reaction] must be proportionate. Civilians must be taken into account, and humanitarian law is very clear on this. I think this limit has been largely exceeded," Prime Minister Jonas Gahr Store aid in a public broadcast radio interview.

"Almost half of the thousands of people killed are children," he stressed. "Israel has the right to defend itself, and I recognize that it is very difficult to defend against attacks from an area as densely populated as Gaza,” Store said. "Rockets are still being fired from Gaza into Israel, and we condemn this."

Israeli flag flies inside Gaza for first time since 2005pic.twitter.com/uc0sJrNyXW

— Lucas Tomlinson (@LucasFoxNews) October 29, 2023

Even the White House has begun to urge caution, with national security advisor Jake Sullivan telling the Sunday shows that even though Hamas used civilians as "human shields" - it's still ultimately Israel's responsibility to avoid hitting them.

"They’re putting rockets and other terrorist infrastructure in civilian areas. That creates an added burden for the Israeli Defense Forces," he said. "But it does not lessen their responsibility to distinguish between terrorists and innocent civilians and to protect the lives of innocent civilians as they conduct this military operation."

Authored by Michael Matulef via The Mises Institute,

The threat of hyperinflation has haunted fiat money economies throughout history. Although past empires crumbled under the weight of unrestrained money printing, modern bankers at the Federal Reserve assure us that today’s financial system is immune to such a fate. Austrian business cycle theory, however, reveals that current economic stimulation may be propelling us toward a crisis of catastrophic proportions: a crack-up boom that marks the dramatic end of this boom-and-bust cycle. When a central bank expands the money supply to reinflate bubbles, it destroys the currency’s purchasing power. This endgame, in which the monetary system crumbles beneath a weak economy, represents the ultimate failure of interventionism.

Once the public expects prices to keep rising, hyperinflation becomes a self-fulfilling prophecy.

To comprehend the precarious state of America’s monetary system, we must first review the boom-and-bust cycle as formulated by Ludwig von Mises and the Austrian school. The Austrians observed that the artificial suppression of interest rates by a central bank initiates an unsustainable economic boom by promoting malinvestment. Pushing rates below natural market levels sends a distorted signal to businesses that long-term capital investment is more profitable than the economy can actually support. In the euphoric boom phase, jobs multiply and GDP grows with investment. But the investments lack economic merit, so the house of cards eventually collapses.

With the liquidation of malinvestments, the bust phase emerges: unemployment soars, output contracts, and a recession begins. Since the investments were built on quicksand, they must unwind. Each failed business further curtails consumer spending, rippling the bust through the economy. But rather than letting liquidation and market corrections occur, policymakers add stimulus, setting up a larger bubble and more painful bust down the line.

At this point, people panic and exchange currency for real assets before rapid devaluation consumes their savings. As the crack-up boom picks up steam, the demand for money plummets while prices of real goods skyrocket, leading to hyperinflation. This psychological shift marks the event horizon where monetary policy is rendered impotent. Mises describes the nature of this crisis:

This phenomenon was, in the great European inflations of the ’20s, called flight into real goods (Flucht in die Sachwerte) or crack-up boom (Katastrophenhausse). The mathematical economists are at a loss to comprehend the causal relation between the increase in the quantity of money and what they call “velocity of circulation.”

The characteristic mark of the phenomenon is that the increase in the quantity of money causes a fall in the demand for money. The tendency toward a fall in purchasing power as generated by the increased supply of money is intensified by the general propensity to restrict cash holdings which it brings about. Eventually a point is reached where the prices at which people would be prepared to part with “real” goods discount to such an extent the expected progress in the fall of purchasing power that nobody has a sufficient amount of cash at hand to pay them.

The monetary system breaks down; all transactions in the money concerned cease; a panic makes its purchasing power vanish altogether. People return either to barter or to the use of another kind of money.

The crack-up brings the unsustainable, debt-fueled boom to a catastrophic end. Personal savings are wiped out along with the monetary system’s credibility. Society becomes less stable as the populace loses faith in institutions and scrambles for resources. The economy finds its ultimate bottom not in recession but in the total decay of the currency itself.

Today, deficits balloon out of control as a result of efforts to sustain demand. Rather than allowing healthy corrections, the Fed piles on monetary stimulus at the first signs of financial crisis. Like an addict, the economy needs increasingly larger doses to maintain the status quo. But this trajectory of interventionism cannot persist forever without severe consequences: the Faustian bargain of trading long-term stability for short-term gain will backfire catastrophically.

With each intervention, the Fed suppresses market corrections, inflates asset bubbles, and encourages high-risk debt. This constant flood of stimulus promotes moral hazard as it optimizes the economy for speculation while curtailing organic productivity. How much longer can this monetary dance along the precipice of hyperinflation continue before the dollar plunges into the abyss?

Despite the veneer of stability, individuals sense that the economy rests on a precarious foundation of debt and deceit. They intuitively grasp that capitalism has metamorphosed into a cronyism that disproportionately rewards those with political connections in an amalgamation of concentrated power, unrestrained money creation, and escalating inequality.

Hoping for a return to monetary and fiscal restraint may prove naively optimistic. Exercising prudence would require immense political courage and social responsibility, qualities rarely exhibited in politics. Politicians face overwhelming incentives to maintain short-term stability through stimulus, spending, and low rates. And restructuring programs with enormous and unfunded liabilities like Medicare and Social Security would spur public backlash, even if it was fiscally prudent.

After decades of excess, the economy is addicted to perpetual stimulus and deficit spending. The prevailing social mindset assumes that unending, debt-fueled growth is the natural state of affairs. With little political will for discipline, reform may depend on a crisis to force change. In the meantime, politicians, paralyzed by the status quo, are unlikely to make the difficult choices that could preempt such a crisis.

It is all but inevitable that central banks will continue expanding the money supply to delay the day of reckoning and preserve the facade until the inevitable hyperinflationary crack-up boom, although the sheer weight of debt alone may produce this outcome. Promises of reform have been made, only to go unfulfilled. In order to prevent disaster, we must fundamentally rethink our monetary and fiscal policies against the temptations of short-term political gain. To quote Ayn Rand:

Just as a man can evade reality and act on the blind whim of any given moment, but can achieve nothing save progressive self-destruction—so a society can evade reality and establish a system ruled by the blind whims of its members or its leader, by the majority gang of any given moment, by the current demagogue or by a permanent dictator. But such a society can achieve nothing save the rule of brute force and a state of progressive self-destruction.

A crack-up boom would erode the power of the federal government: with a dramatic fall in the currency’s purchasing power, the administration’s ability to fund programs and institutions would deteriorate, the Treasury would go bankrupt, and the government would have to either massively downsize or attempt to fund operations by printing even more money. Along with the value of the promissory notes, trust in centralized authority would evaporate.

With the federal government weakened and desperate, power would naturally shift back to individuals and their local communities. When faced with harsh economic realities, communities depend on themselves rather than flailing national policy. Individuals and communities should strengthen their local networks to weather the coming storm, increasing local involvement and forging bonds of cooperation. Joining area organizations and neighborhood groups can foster mutually beneficial relationships and support systems, invaluable resources for when the currency buckles. With shared purpose, communities enhance their capacity to withstand the crisis.

Equally vital are the practical skills and knowledge that can provide real value to others when centralized systems fray. Pursuing expertise in food production, energy generation, medicine, engineering, and other technical fields equips people to meet local needs. In these ways, proactive societies can cultivate the true source of lasting wealth: strong social webs and skilled human capital. Global forces are beyond local influence, but strong communities retain some control over their destiny, even in hyperinflation’s wake.

Praxeological reflection, the methodology of Austrian economics, can expose the unsound foundations that stretch currencies to their breaking point. It cannot foresee when hyperinflation will arrive, but it can point to the causes and guide human action toward stability and prosperity.

There are shocking and surreal scenes coming out of the southern Russian Republic of Dagestan, after word spread that a flight from Tel Aviv was set to land at its international airport.

Rumors that a flight full of Israeli Jews was set to land triggered Muslim mobs to raid the airport, where they broke past barriers and even at one point stormed the airstrip in search of Jews.

In #Dagestan, a crowd stormed the building of Makhachkala airport in search of Jews from a flight from Tel Aviv. pic.twitter.com/TaBvakBKIE

— NEXTA (@nexta_tv) October 29, 2023

"A flight from Israel to the Russian Republic of Dagestan earlier today was forced to divert from its intended destination in the capital of Makhachkala after pro-Palestinians protesters stormed the airport, seeking to attack the Israeli arrivals, according to multiple reports," Times of Israel (TOI) described of the chaotic scene.

Several videos have emerged showing angry rioters yelling "Allahu Akbar" while seeking to intercept offboarding passengers from the Israeli flight.

A Russian Pilot telling Passengers on a Plane at Makhachkala International Airport in Dagestan to not attempt to Open any of the Doors due to the Rioters on the Tarmac which are trying to enter the Aircraft. pic.twitter.com/lwTW0Zg3V6

— OSINTdefender (@sentdefender) October 29, 2023

It appears police or security personnel were nowhere in sight as the mob, reportedly mainly made up of Palestinians who live in Dagestan, rampaged through the terminal.

"Dagestan’s population is overwhelmingly Muslim," TOI noted. "According to Channel 12, the crowd was apparently largely made up of Palestinian expats."

The flight from Tel Aviv either diverted or took off after briefly landing. There are reports that the mob tried to break into a plane on the tarmac. Some reports say that the aircraft which was surrounded was full of Russian citizens.

Some of them tried to storm the plane, per Izvestia https://t.co/js5uaaYkSg pic.twitter.com/bwJuMGH57g

— max seddon (@maxseddon) October 29, 2023

Regional media said the group went so far as to begin checking the IDs of travelers exiting the airport by car:

Some of the signs held by demonstrators read “Child killers have no place in Dagestan” and “We are against Jewish refugees.”

The independent Medizona news website reported that the demonstration was prompted by calls spread on the Telegram messaging app earlier on Sunday to block a plane scheduled to arrive directly from the Israeli city of Tel Aviv.

According to local media, some of the demonstrators were stopping cars outside Makhachkala's airport to check the personal identification documents of drivers and passengers as they searched for Israeli citizens among the motorists.

The flight from Tel Aviv landed at 7:17 p.m. local time, according to the airport's website, after which the protesters stormed into the airport, breaking past security and running onto the tarmac.

One group of people who ran onto the airport's tarmac surrounded a plane and jumped onto one of its wings, the pro-Kremlin newspaper Izvestia reported.

A plane from Israel lands in Dagestan:

— Russian Market (@runews) October 29, 2023

The voice of the flight-attendant: Return into the plane immediately! https://t.co/ADzRxxwqMu pic.twitter.com/6g3IEAAiJf

The FT's Moscow correspondent Max Seddon wrote of one video, "Remarkable to see security forces in Russia standing by for so long. By now, according to Baza, police in Makhachkala have chased them off the runway and outside the airport, where they are now protesting."

The Dagestan airport was forced to temporarily close as the military and police belatedly tried to gain control of the situation and restore order. Per regional N12 News:

"Security official: the event in [Dagestan] is not over yet. A relatively small number of Israelis and Jews are isolated and secured at the airport. We are working for them to take off from there for an onward flight to Moscow as soon as the conditions allow."

When word spread that a plane from Tel Aviv was landing in Dagestan, Russia, a mob stormed the airport in what can only be described as a modern-day pogrom. pic.twitter.com/1G6phfdraz

— Aviva Klompas (@AvivaKlompas) October 29, 2023

Some observers are speculating that security forces essentially turned a blind eye and allowed the disturbing scene to happen.

It is indeed remarkable that given the typical high security nature of international airports, the mob so easily breached all security checkpoints and overwhelmed both the terminal and tarmac.

Authored by Jackson Elliott via The Epoch Times (emphasis ours),

Former cross country runner Teagan Ewings feels a bit bewildered watching her sister, Teanne, run at high school meets.

That's because Teanne Ewings has to run against a boy who identifies as a girl.

"When I was in high school, even the thought of a transgender athlete being in my race was not even on my radar," 21-year-old Teagan Ewings told The Epoch Times.

But much has changed in school sports.

Even just a year ago, a 16-year-old cross-country runner from Maine Coast Waldorf School (MCWS), ran as a boy.

He placed 172nd in the state men's cross country during his freshman year.

But then he grew his short hair out and transitioned to women's cross country. Now, his running times allow him to be considered one of the state's top girl runners.

In a meet on Oct. 5, he won the 5K (3.1 mile) race with a time of 18:09, beating the second-place girl, Emma Young, by 66 seconds.

As of Sept. 26, he ranked fifth in the state among all women and third among the state's small-school athletes, according to online rankings by Maine track and cross country time website MileSplit.

Teanne Ewings ranks second overall and second in the state's division for small-school athletes.

The Epoch Times attempted to contact the male runner, but his Instagram is private. His profile picture shows a crying child, along with the Pride flag and transgender pride flag.

The Epoch Times contacted MCWS but received no comment by publication time.

The Maine Principals Association (MPA) emailed The Epoch Times a statement that state law requires them to include him in women's sports.

"The Maine Principals’ Association is committed to working with schools across the entire state to ensure that Maine State Law is followed," the MPA's statement reads.

"The state of Maine recently enacted laws that explicitly prohibit 'Unlawful educational discrimination in schools based on sex, sexual orientation, gender identity, a physical or mental disability, ancestry, national origin, race, color, or religion.'"

Teagan Ewings said her sister's peers are divided about whether a boy who identifies as a girl should participate in women's cross country.

Some girls told her sister to "run faster" and said sports are all about having fun, she said.

"They just want everyone to have fun, and everybody can do what they want."

Other women see the inclusion of boys as the end of women's sports.

"There's just not going to be female sports anymore," Teagan Ewings said. "It'll just be male sports and then males pretending to be females."

Local parent Cathy Ross has concerns about this, too.

High school boys have far better running times than women, she said.

"There's a handful of us moms who have seen our daughters work like crazy," she said. "These are kids who run over 40 miles a week. Sometimes, at the height of their season, they give up their Saturdays, so that they can travel two-and-a-half hours to a meet far away."

After all of the effort and sacrifice, losing to a man is "crushing" for the girls, Ms. Ross said.

Currently, the young male beats the girls he runs against by two minutes. He's several inches taller than the girls he competes with.

Scientific studies show male hips give men a more efficient running stride than women. Testosterone also allows men to build more muscle than women.

Basically, biology means that he has a larger heart, more leg muscle, larger lungs, and stronger bones than the girls he competes with, Ms. Ross said.

Allowing him into women's sports amounts to Maine giving a special privilege to a man over every girl in the state, she said.

"I don't understand why the gender identity of one individual, and trying to validate that, is seen as far more important than the hard work and the efforts and the need to compete fairly and honestly and to achieve success for girls," Ms. Ross said.

Katherine Collins has a son and daughter in cross country, she said.

The female-identifying runner "is going to get faster because he's getting older," she said. "All he did was grow his hair out and put braids in his hair. I mean, that's all he did. He didn't have to prove anything" to be allowed to compete as a girl.

No matter how much training they endure and dedication girls bring, it's not enough to beat the testosterone advantage, Ms. Collins said.

"The fastest boys' 5K time in Maine is more than two minutes faster than the fastest girls," she said. "There's just no comparison."

Friends have confessed to her that their daughters don't want to compete anymore because they know they'll lose, she said.

And she's frustrated hearing "people say, 'Oh, well, they should just work harder,'" she said. "It's impossible. It's physiologically impossible."

Letting men enter women's sports likely will cost a generation of children their shot at competitive athletics, said Marshi Smith, a former NCAA women's swimming champion,

"How many girls are going to be sacrificed in the meantime?" she asked rhetorically during an interview with The Epoch Times.

"My daughter is 7 right now. In 10 years, that will be her entire childhood athletic career."

For some female students in Maine, the male runner's victories will rob them of accolades that could affect their college applications, Ms. Collins said.

"If you're applying to college and you say that you're nationally ranked or a state champion, that is a big deal," said Ms. Collins.

So his inclusion is a "slap in the face" to female athletes, Ms. Collins said.

"The MPA doesn't care about girls," she said. "They don't care about women."

Parents in Maine opposed to allowing a boy to compete as a girl have few options to change the situation, Maine parental rights advocate Shawn McBreairty told The Epoch Times.

But parents can file complaints with their local school district citing Title IX, the landmark U.S. law meant to bring equity between men and women in most facets of education, Mr. McBreairty suggested.

If that doesn't change things, they can consider filing lawsuits, he said.

Although the boy didn't crack the top 100 of Maine's male runners, he's one of the best "female" runners in the state, Mr. McBreairty said.

The MPA's handbook includes the word "gender" 39 times and the word "transgender" nine times.

"The MPA supports student-athletes regardless of their gender identity or expression," the handbook reads. "The MPA also recognizes that high school sports teams have traditionally been binary [single sex] and believes that it is important to continue to offer single-sex interscholastic athletic teams in order to ensure equal athletic opportunities for girls."

The handbook also states that "most high school-aged boys have a distinct athletic advantage" over girls.

The MPA's Gender Identity Equity Committee (GIE) can decline a request for cross-sex competition—when a boy who identifies as a girl asks to compete with girls—if members are convinced the student is only pretending to be transgender, the handbook reads.

The GIE committee makes this decision under a long list of criteria.

Some criteria involve physical traits like height, weight, previous athletic performance, and whether a student has passed puberty.

Other criteria include whether the student has consistently identified as transgender, whether a student has already changed their gender identity in school records, and what sports the student plans to do.

However, no test can determine if someone is transgender because "gender identity is an internal identification and experience," according to guidelines from the World Professional Association for Transgender Health (WPATH).

The MPA handbook also states that the committee can decline a student's request to play on opposite-sex teams if the student would gain an "unfair athletic advantage or pose an unacceptable risk of physical injury to other student-athletes."

Parents wonder how the current case, in which one participant jumped more than 100 places up in ranking when switching to compete as a girl, can be within the bounds of fairness by the MPA's standards.

"They're acknowledging that boys have an athletic advantage," Ms. Ross said.

"Basically, they don't intend to do anything about it."

Attacks on US military outposts in Iraq and Syria have continued over the weekend. Al-Mayadeen news and other regional outlets have reported that there have been several attacks by Iran-backed militias on Saturday and Sunday. Russian media has also reported on the fresh attacks, calling recent Pentagon airstrikes on Syria an "unsuccessful bid to deter the militias."

A statement by a coalition of Shia paramilitary groups said, "The Mujahideen of the Islamic Resistance in Iraq targeted the American occupation base in Al-Tanf, Syria, with two drones, which directly hit their targets." They carried out the attack from just across the Iraq border into Syria.

Reports say separately that the al-Shaddadi base in eastern Syria was also hit with two drones, and al-Omar base and oil field was struck. The latter was reportedly attacked a mere hours after the US airstrikes.

Al-Mayadeen had says ago cited a statement from the Iraqi Hezbollah Brigades which said the group is willing to fight "a war of attrition against the enemy that will extend for years."

In the early hours of Friday, the US had sent fighter jets to attack multiple locations of Iran-linked paramilitaries in Syria. The Associated Press summarized the action based on US official statements as follows:

Air Force Brig. Gen. Pat Ryder said Friday that the strikes near Boukamal by F-16 and F-15 fighter aircraft targeted a weapons storage facility and ammunition storage facility used by the IRGC and affiliated groups. “Both facilities were destroyed,” he said. “We currently assess there were no casualties in the strikes.”

"These precision self-defense strikes are a response to a series of ongoing and mostly unsuccessful attacks against US personnel in Iraq and Syria by Iranian-backed militia groups," US Defense Secretary Lloyd Austin said in the aftermath.

“Iran wants to hide its hand and deny its role in these attacks against our forces. We will not let them. If attacks by Iran’s proxies against US forces continue, we will not hesitate to take further necessary measures to protect our people,” he added.

Iraqi Shia militias have released a video of them launching a suicide drone toward a U.S. military base.

— Visegrád 24 (@visegrad24) October 28, 2023

A Palestinian flag is showed on the drone before it is launched.

More than 20 U.S. soldiers have been wounded in recent attacks on military bases in Syria and Iraq. pic.twitter.com/OB7VHDGsyb

But given the rocket and drone attacks have continued into the weekend, it's become clear that these US strikes didn't have the desired deterrent effect.

US spy plane fights along the eastern Mediterranean, including stepped up drone activity, have increased in relation to Israel's ongoing ground assault on Gaza.

Poor sugar and cocoa harvests in Mexico, India, and the Ivory Coast, primarily due to El Nino-induced weather disturbances like low rainfall, have caused a spike in candy prices for the second consecutive year. Surging prices are leading some consumers to trade down to value or store-brand candy this Halloween, according to AP News.

Data from retail price tracking website Datasembly reveals consumers have been slapped with the second year of double-digit inflation in the candy aisle. Prices for candy jumped 13% this month compared to prices last October. That's up from a 14% increase in candy in October 2022.

"The price of candy has gotten to be outrageous," Jessica Weathers, a small business owner in Shiloh, Illinois, told AP. She usually buys plenty of candy for the trick-or-treaters, but this year, she only bought two bags, indicating, "It doesn't make sense to me to spend $100 on candy."

This Halloween, one-third of consumers are planning to trade down to value or store brands when buying candy for trick-or-treaters, according to market research firm Numerator.

Data from the Bureau of Labor Statistics show candy prices have rocketed higher in the last several years.

El Nino weather trends have meant drier conditions for Asia, Central America, and West Africa, which are major growing areas for cocoa and sugar.

Cocoa prices rocketed to 44-year highs on drier conditions across West Africa.

"There may be no price relief in sight, at least through the first half of 2024," said Dan Sadler, principal of client insights for Circana, a market research firm.

Global sugar prices have surged to 12-year highs as parts of Asia experienced dry weather that dented harvests.

"The US candy consumer is essentially paying the price for poor crops in Mexico and also Asia," John Stansfield, a senior sugar analyst at commodity data platform DNEXT, told NYTimes.

For some context, at the supermarket, candy inflation means consumers can expect a 250-piece variety pack of Mars Inc. chocolate bars to cost around $25, versus the same package was $19.50 two years ago.

Last week, Hershey's CEO Michele Buck warned: "We know that value and affordability continue to be top-of-the-line for consumers as budgets are stretched."

Authored by Aaron Pan via The Epoch Times,

The survey found that 60 percent of Americans are falling behind on their savings for emergencies, in which 38 percent said they are significantly behind...

A large majority of Americans are falling behind on their savings, as 81 percent have not increased their emergency savings since the beginning of the year, according to a survey.

The survey by Bankrate, released on Oct. 25, showed just 19 percent of American households increased their emergency savings, while 32 percent have less savings now compared with the beginning of 2023. Thirty percent of households have the same amount of savings, while 20 percent had no emergency savings at the start of the year and remain having none.

In terms of age, older generations tend to have less emergency savings now than at the beginning of the year.

According to the survey, households with income over $100,000 tend to have more savings now than at the beginning of the year.

In addition, the survey found that 60 percent of Americans are falling behind on their savings for emergencies, in which 38 percent said they are significantly behind and 22 percent said they are slightly behind.

Among those who said they were falling short on their savings, 13 percent said they would never be on track, while 22 percent said they were uncertain how long it would take.

The poll also found inflation is the main impediment that prevents Americans from increasing their savings amid renewed concern over long-term price hikes. Fifty-seven percent of households who suffered no saving increase blamed inflation for their issue, while 38 percent cited too many expenses that hurt their saving funds.

"Just 19 percent have increased their emergency savings balances since the beginning of the year. Rising prices and high household expenses have been the predominant impediments to boosting emergency savings," said Bankrate chief financial analyst Greg McBride.

The survey was conducted online with 2,496 adults from Sept. 20 to 22.

The Federal Reserve Bank of New York revealed on Oct. 11 that Americans' disposable income has fallen, and consumers are increasingly dipping into savings to prop up consumption.

From the beginning of the pandemic in 2020 through the end of 2021, Americans' excess savings grew to roughly $2.6 trillion, or 14 percent of annual disposable income, according to the New York Fed.

Since then, U.S. excess savings have steadily fallen, dropping to 10 percent of disposable income—or $1.9 trillion—by the second quarter of 2023.

Data for the first two months of the third quarter cited by the New York Fed show that consumers have generally maintained their propensity to spend, but as real disposable income has fallen, they've increasingly been drawing on their savings to continue shopping.

Amid persistent inflation, retirement savings also take a hit as more Americans make hardship withdrawals from their retirement funds to cover emergency needs.

USA Today cited a report from Fidelity Investments, reporting that hardship withdrawals from 401(k) accounts have tripled from 2.1 percent in 2018 to 6.9 percent in 2023.

Moreover, hardship withdrawals at Vanguard have doubled during the 2018-2022 period, increasing from a monthly rate of 2.1 transactions per 1,000 participants in 2018 to 4.3 in 2022.

Nearly 50 percent of Americans say high prices are eroding their living standards—a record number that matched the all-time high set in July 2022, when the pace of inflation was a whisker away from breaking into the double digits.

"After stabilizing earlier this year, concerns about inflation have grown again," reads the latest University of Michigan Surveys of Consumers report, released on Oct. 13.

The survey shows that 49 percent of consumers polled in early October said high prices eroded their living standards. That's up substantially from last month's 39 percent and matches the all-time high notched in July 2022.

Inflation, as measured by the Consumer Price Index (CPI), shot up at a furious pace through 2021 and narrowly missed breaking the 10 percent psychological barrier by mid-2022.

The rising prices peaked at 9 percent in June 2022, a multi-decade high that later fell to 3.1 percent by June 2023. However, inflation in August and September jumped back up to 3.7 percent, bringing renewed concerns about inflation.

What's more, year-ahead inflation expectations have jumped, rising from 3.2 percent in September to 3.8 percent in early October, per the University of Michigan survey.

Longer-term inflation expectations also rose to 3 percent this month from 2.8 percent last month.

With its only commercial tenant out, the legendary Flatiron Building at 175 Fifth Avenue is being converted into luxury housing.

The building has recently "fallen on hard times", including seeing its only office tenant, Macmillan Publishers, move out before Covid, according to a report by The New York Times. This has prompted the building's owners to redevelop the property.

A buyer had previously won an auction for the building back in March, but never showed up when it was time to cut the check. This past week, residential developer the Brodsky Organization bought a stake in the building and will lead the conversion according to the Times.

The triangle-shaped building will now feature condominiums or rentals. Dean Amro, a principal at the Brodsky Organization, says he believes the project shows the company's "confidence in New York coming back even stronger than before.”

Sure, as long as you're not talking about commercial real estate...

But we digress. The project is slated to take about 3 years, according to the Times. Approval from the Department of City Planning could take as much as a year, while demolition and construction would take up to two years.

Plans are still in flux, but roughly 40 residential units are under consideration, while the ground floor will remain retail. Real estate expert Jonathan J. Miller believes the shift aligns well with the stagnant office market and sees potential for the project to succeed as a residential landmark.

Since Macmillan's departure in 2019, the Flatiron's upper floors have remained vacant, and a court-ordered sale occurred earlier this year due to previous ownership disputes over renovation plans. The Flatiron district itself is among Manhattan's priciest and most coveted residential areas.

Jeff Gural, an office developer who was the Flatiron’s majority interest holder, had hoped to maintain some of the office space in the building. But he eventually conceded that "current economic conditions" made it clear that the building would be "better suited for residences".

Which is, of course, a nice way of saying, even commercial real estate developers don't want to be in the business of commercial real estate right now...

He concluded: “There are going to be 40 people who want to live in the Flatiron Building.”

China is Apple's third-largest market after North America and Europe, and mounting data from research firms shows iPhone 15 demand is sluggish after the launch in late September. This comes as Huawei Technologies Co.'s return to the mobile market with the Mate 60 series is a big hit.

Sales of iPhone 15 models in September (launch month) fell 6% compared with the prior year, according to Bloomberg, citing an estimate from market researcher GfK. For the third quarter, a separate report from mobile industry tracker IDC shows Apple's shipments were down 4% in the quarter. Both reports indicate that the Mate 60 series launch, one week before the iPhone 15 launch, dented sales for Apple. GfK said the Mate 60 series recorded sales of 1.5 million in its launch month, doubling from a year ago.

"Against the backdrop of the strong growth of Huawei, Apple iPhone 15 series registered a 6% decline in sales," said Hayden Hou, China senior analyst at GfK

Hou continued, "Huawei Mate 60 series will continue to maintain its strong sales momentum going forward."

The Mate 60's cutting-edge, made-in-China processor is a major victory for Chinese tech despite US sanctions on chips. Another developing issue for Apple is the Chinese government broadened a ban on iPhones at government agencies and state companies.

In mid-October, Jefferies and Counterpoint Research warned about sliding Chinese iPhone demand - just weeks after launch.

Jefferies analysts led by Edison Lee said, "The trend suggests iPhone would lose to Huawei in 2024 - We believe weak demand in China would eventually lead to lower-than-expected global shipments of iPhone."

What's worrisome for Apple is that it gets about 20% of its revenue from China. The apparent nationalism wave among Chinese consumers because of US sanctions appears to be shifting demand from iPhones to Mate 60 phones.

"We're seeing a lot of nationalism right now as Chinese consumers who think they've been wronged by the US government and sanctions are gravitating toward the Mate 60 and that is edging into Apple volumes," Jeff Fieldhack, research director at Counterpoint, told CNN earlier this month.

There are risks that the Biden administration's semiconductor restrictions are falling, as one tech insider revealed last week that the West won't hinder China's rise in chip advancements.

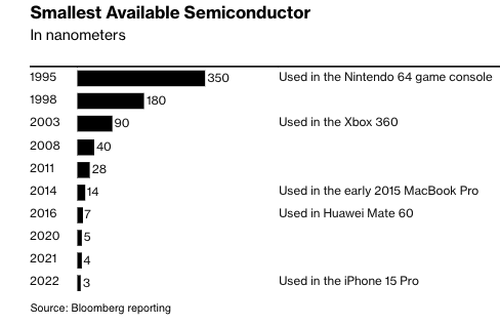

The latest iPhone 15 is equipped with 3-nanometer chips, whereas the Mate 60 series operates using 7-nanometer chips.

There are expectations that China will soon be running smartphones on 5-nanometer chips.

Ending a week that saw the S&P be the most overshorted in history, with Goldman PB reporting that its HF clients had shorted stocks for a record 12 consecutive weeks, it was inevitable that we would get an oversold bounce at some point and this morning we are seeing just that, with stocks in Europe broadly higher, and US equity futures also rising and reversing all of Friday's loss. As of 7:45am, S&P futures were higher by 0.7%, Nasdaq futures gained 0.8% and the Estoxx rose 0.8% in early London session with gains led by utilities and energy; WTI futures were lower by 1.1% on the day because the complacent market downplayed the Israeli ground offensive into Gaza as "less aggressive than feared." Ahead of a very busy week, JPM summarizes sentiment as follows: "are futures potentially setting up a relief rally into month-end or does the selling pressure continue with SPX under its 200dma." Gold slipped below $2,000 an ounce, the dollar dropped as bitcoin gained and ten-year Treasury yields resumed their grind higher to 4.86% ahead of today's Treasury issuance projections statement.

In premarket trading, HSBC was steady after the bank’s further share buyback of as much as $3 billion offset news of a pretax profit of $7.71 billion that fell short of analyst estimates. Cisco shares are little changed after the digital communications technology company was downgraded to market perform from outperform at Raymond James. Here are some other notable premarket movers:

As usual we start with geopolitics, where instead of a massive ground invasion, newsflow over the weekend revealed that the Israeli military has started slowly and according to Bloomberg, "so far there are few signs that the conflict will spread across the wider Middle East region" (the shekel took a pause from recent selling, gaining 0.4% at 4.0566 but remains the world’s worst-performing currency this month, recently hitting 11-year lows). That’s being seen as enough good news for investors to wade back into markets after last week’s sharp selloff, which sent the S&P 500 into a correction on Friday after the index closing 10% below a recent peak.

"The relatively contained operations over the weekend were perhaps a relief to markets, who are worried about other players being dragged into the conflict,” said James Rossiter, global head of macro strategy at TD Securities. “That should bode well for some risk assets. That said, there are definitely a few risk events for markets to chew on this week.”

Still, stocks globally have lost $12 trillion in value since the end of July - aka since the Fed's last rate hike - as concern mounts that central banks’ “higher-for-longer” interest-rate policies may tip the global economy toward a recession. The S&P 500 entered a technical correction and Morgan Stanley strategist Michael Wilson said investors hoping for a boost to stocks by the end of the year will be disappointed.

The week also includes a slew of potentially market-moving events for investors to track, including central bank meetings in Japan, the US and the UK, while the US Treasury Department announces its quarterly bond sales plan. Concern that central banks’ “higher-for-longer” interest-rate policies may tip the global economy toward a recession.

Government bonds have also tumbled, with 10-year Treasury yields hitting a 16-year high last week, despite signals from policy makers they’re “at or near” the end of rate hikes. Bond yields remain high even after the outbreak of the Israel-Hamas war three weeks ago – the kind of geopolitical flashpoint that can spur haven demand for Treasuries. On Monday, the Treasury will set the stage for its issuance plans with an update of quarterly borrowing estimates, and for its cash balance.

European stocks also rose, with the Stoxx 600 gaining 0.7% as all 20 sectors rise after data showed German inflation eased further, while its economy shrank in the third quarter, as Europe slides into its next recession. Travel & leisure and retail sectors the biggest gainers, while automotive shares gained the least. Siemens Energy is among top performers, rebounding after its board chairman moved to reassure investors over state aid concerns. Here are the most notable European movers:

Earlier in the session, Asian stocks declined as weak corporate earnings took center stage amid continued concerns over high US interest rates, geopoliitcal tensions and China’s economy.The MSCI Asia Pacific Index slid as much as 0.6%, with Toyota and Alibaba among the biggest drags.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Aussie is the strongest of the G-10 currencies after retail-sales data beat estimates, an outcome that may boost the Reserve Bank of Australia’s confidence that the economy can withstand further interest-rate hikes. The Swiss franc was the weakest. The recent rebound in the Aussie “is spurred by higher iron ore prices, rising expectations for the RBA to deliver one more rate hike,” strategists at Malayan Banking Bhd. led by Saktiandi Supaat wrote in a research note. “We see more room for upside than down” for AUD/USD, they said. The Swedish krona underperformed G10 counterparts after a flash estimate showed the economy was stagnant last quarter

In rates, treasuries were cheaper across the curve, with losses led by front and belly, unwinding a portion of Friday’s sharp 5s30s steepening move. US yields cheaper by up to 5.5bp across belly of the curve, with 5s30s spread flatter by 3bp on the day; 10-year yields around 4.88%, cheaper by 4bp vs. Friday close with bunds and gilts outperforming by 5.5bp and 2bp in the sector. Safe-haven demand eased for Treasuries, pushing yields slightly higher after the market lulled itself into complacency again, and instead of believing in a ceasefire any moment, today the narrative was that "Israel’s military action in Gaza proceeded more cautiously than anticipated." At this rate anything else that mushroom clouds will be bullish. Meanwhile, bunds are higher, the curve bull steepening as S&P futures advance, boosted by German state inflation readings that point to a lower-than-expected national CPI print later today. Data also showed the German economy shrank in the third quarter.

In commodities, oil prices fell, along with gold and Treasuries. WTI falls 1.2% to trade near $84.50. Spot gold drops 0.5%. Iron-ore futures traded in Singapore rose after posting their first weekly gain in more than a month amid optimism that China’s authorities will step up their efforts to support growth

US economic data includes October Dallas Fed manufacturing activity at 10:30 a.m. New York time; employment cost index, consumer confidence, manufacturing PMI, ADP employment change, ISM manufacturing, factory orders and jobs report also due this week. Fed officials are in self-imposed quiet period ahead of Nov. 1 rate decision; Treasury quarterly debt refunding announcement also due Nov. 1

Market Snapshot

Top Overnight News

A more detailed look at global markets

APAC stocks ultimately traded mixed but with the major indices mostly in the red as geopolitics continued to dominate headlines ahead of month-end and this week’s slew of upcoming risk events. ASX 200 was led lower by underperformance in energy and the top-weighted financial sector although the index moved off intraday lows as participants also digested stronger-than-expected Australian Retail Sales data. Nikkei 225 suffered as yields edged higher and the BoJ kick-started its 'live' 2-day policy meeting. Hang Seng and Shanghai Comp were both initially lower with financials pressured after mixed earnings from some of the large banks including China’s biggest commercial lender ICBC which posted flat profit for Q3, while there was turbulence in Evergrande shares owing to a wind-up hearing which was adjourned to December 4th. Nonetheless, the declines were stemmed in the mainland amid hopes of improving US-China ties after US Secretary of State Blinken met with Chinese Foreign Minister Wang Yi and agreed to work towards a Biden-Xi meeting in November.

Top Asian News

European bourses, Euro Stoxx 50 +0.7%, began the week on the front foot after a mixed APAC handover. Focus since has been on the geopolitical front and data, with reports of tanks around Gaza City briefly halting sentiment for the region. Sectors are all in the green with no overarching bias, Energy and Banks lagged initially given benchmarks and an update from JPM on the European sector respectively. Stateside, futures are in the green ES +0.6% ahead of the latest Treasury Estimates before Wednesday's refunding announcement. As it stands, the NQ is experiencing some modest outperformance and perhaps aided by the modest EGB bid on data.

Top European News

FX

Fixed Income

Commodities

Geopolitics

Israel-Gaza

Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

We start a busy week for markets after a few major landmarks were reached on Friday that are worth highlighting. The S&P 500 moved into "correction" territory, now down -10.27% from the July highs. Meanwhile the benchmark small-cap Russell 2000 index went through its June 2022 lows and back to levels last seen in November 2020, around the time that Pfizer announced the first successful Covid-19 vaccine trials. In fact, it's now back to levels it first breached in November 2018. When you factor in the huge inflation over this period, that's some serious real adjusted declines. So for all the optimism surrounding US equities this year it really is only a handful of huge companies that's skewing the positivity.

The move into correction territory comes as we hit a very busy week of important central bank meetings, data, earnings and a fresh Treasury refunding announcement. The BoJ could be the stand-out (tomorrow) as our economist believes (close call) they will revise YCC. That could overshadow the FOMC (Wednesday) and the BoE (Thursday) meeting. In terms of data all roads point towards Payolls on Friday, with ADP and JOLTs (Wednesday) providing the warm-up act. Elsewhere US ISM Manufacturing (Wednesday) and Services (Friday) will be a focal point as will the various global PMI numbers, especially China's.

Over in Europe, the highlights will include the preliminary October CPIs and Q3 GDP reports for Germany today, followed by France, Italy and the Eurozone on Tuesday. Earnings will be in full flow but with Apple on Thursday the highlight. The full day-by-day calendar is at the end as usual but we'll preview the highlights in more detail now below.

Starting with the BoJ tomorrow, our Chief Japanese economist (see full preview here) expects the central bank to revise its monetary policy framework but acknowledges it is a close call. They are likely to revise up their inflation forecast for the second successive Outlook Report which makes it hard for them to do nothing. Our economist would favour the abandonment of YCC but acknowledges that local media have suggested a bias towards tweaks. In his view, even if the BoJ maintains the status quo, the YCC is likely to come under further pressure as expectations of policy normalisation build up .

For the Fed on Wednesday, our US economists expect the central bank to stay on hold and see future hikes as a function of financial conditions and the path of the economy. While their baseline is for rates to stay at 5.3% through year end, they see an increasing risk of a hike in December or Q1. They also recently published a note on what the recent tightening in financial conditions mean for the Fed here. Linked into financial conditions, the latest US financing estimates (today) and refunding announcement (Wednesday) will be important given how much the early August equivalent spooked the market given the extra supply that it heralded. There is some hope that the Treasury may pause its coupon increases it flagged back in August. However our strategists think this is unlikely. See their report here. Remember the August refunding announcement has arguably proved to be the most important macro event of the last 3 months .

The BoE will round out the busy week for central banks on Thursday and our UK economist expects no change in the Bank Rate (5.25%) or the Bank's forward guidance. The full preview of the meeting here also touches on central bank's forecasts as well as QT. Elsewhere in Europe, Norges Bank will also decide on its monetary policy that day as well.

In terms of payrolls, our US economists expect the headline to come in at 140k (consensus 190k), down from +336k in September with the UAW strike causing around a 35k drag. They also see the unemployment rate remaining at 3.8% (same as consensus). There will be plenty of labour market data before hand with the ECI (tomorrow), JOLTS and ADP (Wednesday), claims (Thursday), and all the employment subcomponents within the PMI surveys.

German GDP today will likely see a -0.3% contraction (consensus -0.2%) with a mild contraction of -0.1% (consensus 0.0%) in the wider Euro area (tomorrow ). Our economists also expect the headline inflation measure for the Euro area to further decline to 3.1% from 4.3% in September, and see the core gauge slowing to 4.1% (4.5%).

Elsewhere, reports indicate Chinese officials may gather as early as today for the National Financial Work Conference that takes place once every five years behind closed doors. The real estate turmoil as well as other financial risks will be key discussion points.

Equity markets in Asia are mixed this morning as continued concerns over the direction of the Israel-Hamas war are being tempered by the fact that major escalations have been avoided so far. As I check my screens, the Nikkei (-1.20%) is the biggest underperformer as the Bank of Japan (BOJ) starts its two-day monetary policy meeting. Elsewhere, the Hang Seng (-0.28%) is also trading in negative territory while the CSI (+0.67%), the Shanghai Composite (+0.17%) and the KOSPI (+0.46%) are higher. S&P 500 (+0.33%) and NASDAQ 100 (+0.51%) futures are seeing a decent bid for the time of day. US Treasury yields are 2-4bps higher across the curve as we go to print.

Early morning data showed that retail sales in Australia advanced at the fastest pace in eight months, rising +0.9% m/m in September (v/s +0.3% expected) accelerating from August’s upwardly revised +0.3% increase thus encouraging some expectation of a hike at the RBA meeting next week. The Australian dollar (+0.28%) is trading at 0.635 versus the dollar while 3yr yields are up around 5bps. Oil prices have dipped in Asia with Brent futures (-1.36%) slipping back below $90/bbl.

Now, reflecting on last week, on Friday we had the PCE data for September. Headline PCE inflation came in at a four-month high of +0.4% month-on-month (+0.3% expected), while core PCE was in line with expectations at 0.3%. In year-on-year terms, headline was at 3.4%, while core PCE inflation was 3.7% (both as expected). This slight upside came as the strength of consumer spending showed no sign of abating, after nominal personal spending jumped from 0.4% in August to 0.7% month-on-month (vs 0.5% expected). In other data, the University of Michigan survey saw 1-year inflation expectations unexpectedly rise to a five-month high (from 3.8% to 4.2%), though longer-term expectations were flat at 3.0% .

The data did little to budge near-term Fed expectations, with markets pricing a 16% chance of another hike by year-end (from 19% Thursday and 20% a week earlier). Our economists noted that while the core PCE print was the strongest since April, its pace would need to pick up marginally further in Q4 to meet the September SEP projections for end-23. Bonds saw a decent rally last week, with 10yr Treasury yields down -7.9bps to 4.84% (-0.9bps Friday). Renewed curve steepening was a key theme on Friday, with the 2yr yield down -3.8bps to 5.00% but the 30yr up +2.8bps to 5.01%. This marks the first time since August 2022 that the 2s30s slope has closed in positive territory .

After an ECB meeting on Thursday that delivered as expected, although with some dovish tilts, German 10yr bunds yields closed down -5.8bps last week (-3.0bps Friday). We heard from ECB’s Nagel on Friday, who stated that “tight monetary policy is showing effect”, with “future decisions to be made meeting by meeting”. So one of the hawks sticking to the tone of Thursday’s meeting.

In equities, the main story at the end of last week was the S&P 500 entering correction territory, down -10.27% from its end-July peak. The index was down -0.48% on Friday and -2.53% on the week. The -4.86% decline over the past two weeks is its sharpest in 10 months. Equities had started Friday on the front foot after strong earnings results from the likes of Amazon (+6.83% Friday) and Intel (+9.29%) the previous evening. This saw consumer discretionary (+1.70%) and information technology (+0.58%) sectors outperform on an otherwise negative day (with 82% of S&P constituents down on Friday). The NASDAQ benefitted from late week tech earnings, gaining +0.38% on Friday (but still down -2.62% week-on-week). Europe was similarly gripped by the risk-off mood, with the STOXX 600 down -0.84% on Friday (and -0.96% week-on-week) .

The largest underperformer in the S&P on Friday was the energy sector, falling -2.30%. This followed disappointing earnings reports from Exxon Mobil and Chevron, which slipped -4.98% (and -1.91% on Friday) and -13.47% (-6.72% on Friday) over the week respectively. Friday’s decline in energy stocks came despite Brent and WTI crude prices jumping +2.90% and +2.80% respectively on Friday after news that Israel forces undertook a second raid into Gaza, destroying Hamas naval infrastructure. However, oil prices still declined on the week, with Brent down -1.82% to $90.48/bbl and WTI down -3.62% to $85.54/bbl .

Gold secured a third consecutive week of gains, rising +1.26% (and +1.11% on Friday) to $2,006 per ounce, its first time above $2,000 since May.

Authored by Melanie Sun via The Epoch Times,

A federal judge has reinstated a gag order she previously ordered on former President Donald Trump in the Department of Justice’s federal election case accusing him of trying to overturn the results of the 2020 election.

U.S. District Judge Tanya Chutkan had initially approved President Trump’s request for an administrative stay, or pause, on the gag order requested by government prosecutor special counsel Jack Smith. The gag order prohibited remarks that would "target" the prosecution and defense legal teams, court staff, and potential witnesses.

In Judge Chutkan's initial written opinion, she dismissed arguments made for First Amendment defenses, writing that the obligation to protect the proceedings from outside interference preceded First Amendment rights.

President Trump’s legal team had requested the pause while the merits of the case were being considered by an appeals court. They said the gag order would deny his protected political speech, and the rights of President Trump's audience to hear his remarks.

However, the government filed its opposition to the temporary lifting of the gag order, after which President Trump had three days to file a response to the opposition, which he did on Saturday.

"The Gag Order would not have done anything to prevent a national discussion of this issue during a campaign. Thus, the only thing the Gag Order would accomplish is ensuring that President Trump could not respond to inappropriate prosecutorial or witness leaks, an obviously impermissible and wholly unconstitutional goal,” Trump’s attorneys argued.

With arguments from both sides now made, the judge has sided with the prosecution, denying President Trump’s request to pause the gag order during the appeals process. The ruling appeared in a docket entry on Sunday night, but the details of the ruling have not yet been made public.

President Trump responded to the judge’s action in a late Sunday post on his social media platform Truth Social, saying that his First Amendment rights had been breached.

"The Corrupt Biden Administration just took away my First Amendment Right To Free Speech," he wrote. "NOT CONSTITUTIONAL!"

The American Civil Liberties Union (ACLU) came out to advocate for what it believes are President Trump's First Amendment rights in a rare statement of support, describing Judge Chutkan's order as "vague" and "impermissibly broad" in restricting the former president's free speech.

President Trump is also subject to a gag order in the civil case in New York being pursued by Attorney General Leticia James.

In recent submissions for the election case, the defense has added in its arguments that President Trump was never charged with inciting violence on Jan. 6. They are seeking to strike prosecutors’ public statements that have implied this as a given fact from the indictment.

President Trump has pleaded not guilty to the charges that he plotted to unlawfully interfere in the counting of votes and block the congressional certification of contested state votes on Jan. 6, 2021.

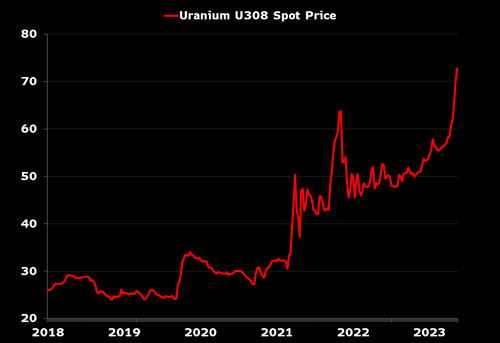

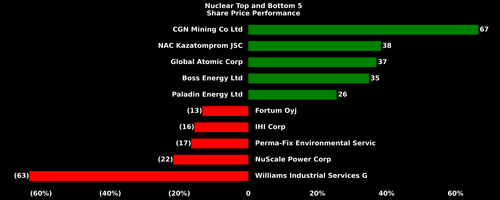

As uranium ore trades at records highs, several hedge fund managers are expanding their allocations to uranium stocks, with a conviction that an increasing embrace of nuclear energy as part of a "green" future -- along with geopolitically-rooted ambitions to reduce dependence on Russian oil and gas -- means the trend has a lot of room to run.

A dozen years after the disaster at Japan's Fukashima reactor put nuclear energy on worldwide probation -- and in, Germany, gave it a death sentence -- various factors are combining to bring it back into the acceptable realm of energy solutions.

First, the International Energy Agency says that, in order to meet "net zero" goals -- which describes a state where carbon emitted into the atmosphere matches the amount removed from it -- global nuclear generation capacity must double from 2020 levels by 2050.

In addition to nuclear energy coming to the fore as a zero-carbon-emitting power source, it's also seen as a way for the western economies to reduce their need for Russian oil and gas. The fact that Russia currently accounts for about 8% of the world's uranium reserves underscores the need to develop new supply sources. There's also an increasing appetite for nuclear power in Asia and Africa.

Taken together, the uranium-friendly trends could power significant gains in the sector. "[Uranium] equities could see dramatic upside -- 50%, 100%, possibly more," Terra Capital’s Matthew Langsford told Bloomberg in a report published Sunday.

Langsford has been building positions in Denison Mines Corp and NexGen Energy. Headquartered in Vancouver, BC, NexGen is exploring a new Canadian mine thought capable of producing a quarter of the world's supply. If so, NexGen would be “very important for the nuclear industry in the 2030s, which could end up being the golden age of nuclear power,” said Langsford.

“We’re most focused on uranium miners in public markets,” Arthur Hyde, a portfolio manager at Segra Capital, told Bloomberg. “For the supply and demand of this market to balance, we need new assets to come online...If you’re going to insulate the US, Europe and Canada from the global fuel cycle, which is heavily dependent on Russia and China, the best way to do that is to build new mines, new conversion capacity, new enrichment capacity.”

That's not to say everyone's exclusively playing the long side. Hyde, for one, told Bloomberg he's thinking of shorting Cameco Corp after a 70% surge in 2023. Meanwhile, he's bullish on Ur-Energy and Energy Fuels Inc.

Stellantis NV, maker of the Jeep, Ram and Chrysler brands, reached a tentative agreement with the UAW on Saturday, which included the same 25% hourly pay raise plus cost-of-living allowances over the more-than-four-year contract included in a similar deal reached by Ford last week.

Those agreements still need to be voted on by the companies’ union members.

And now, after more threats from the UAW, Bloomberg is reporting that GM is said to have reached a tentative agreement with UAW to end the strike that is costing them billions.

GM Chief Executive Officer Mary Barra and UAW President Shawn Fain reportedly spoke on Sunday, people familiar with the discussions said.

Bloomberg reported that the automaker and UAW made progress on the status of temporary workers but still needed to agree on retiree benefits, the people said.

With 300,000 retirees - the most of any automaker - a $500 annual payment would cost the company $150 million a year for the life of the deal.

The deal reached Monday includes a 25% hourly pay raise plus cost-of-living allowances over the more-than-four-year contract, according to the person, who wasn’t authorized to speak publicly.

The agreement still needs to be approved by GM’s union members.

For context:

Detroit automaker unionized labor costs, including wages and benefits, are estimated at an average of $66/hour.

That compares with $45 at Tesla, which isn’t unionized, and $55 for Asian automakers.

Meeting all of Fain’s initial demands would boost average hourly labor costs to an estimated $136/hour.

Fein claims to be matching the roughly 40% compensation gains automaker CEOs have realized in the past decade.

Ford’s CEO made $22mm last year. Stellantis’s $24.8mm. GM’s nearly $29mm.

“Competition is code word for race to the bottom, and I’m not concerned about Elon Musk building more rocket ships so he can fly in outer space and stuff,” Fain told CNBC, defending his demands.

“Our concern is working-class people need their share of economic justice in this world.”

As Eric Peters warned over the weekend: "The secular trend toward ever rising inequality is turning."

"In August, UPS settled its labor dispute with the Teamsters 340k drivers who on average now make $170k in wages and benefits. That same month, Yellow failed to come to agreement with the Teamsters and ceased operations after nearly a century of trucking delivery -- it awarded ten executives $4.6mm in special retention bonuses, laid off all 30k drivers and went into liquidation. A secular trend reversal to how society divides its economic spoils is not all that different from revolution. Bitterly fought, treacherous for all involved.

And this latest episode promises to be particularly so.

Because in the timeless conflict between capital and labor, it is extremely rare for the imbalance to be so extreme.

The wider the gap, the bigger the stakes.

And the last time the chasm was so great was at the height of the Roaring 1920s."

GM shares are up in the pre-market, but not very impressively - perhaps on the reality of what this will do to the company's bottom line...

As Eric Peters exclaimed yesterday, in the end its the taxpayer that will foot this giant bill:

“We hit the companies to maximum effect,” said UAW President Shawn Fain in a Facebook livestream. GM and Stellantis [and now GM] had just agreed to provide a 25% wage increase to United Auto Workers members, matching the same offer by Ford to end the six-week strike.

The gains are valued at more than four times those won in the last UAW contract in 2019 and provide more in base wage increases than Ford workers have received in the past 22 years.

The deal will reinstate major benefits lost during the Great Recession, including cost-of-living allowances. Some lower paid workers will receive an immediate 85% wage increase.

This is the sort of thing that happens in a relatively free market when capital owners have extracted such a large share of the nation’s economic spoils that labor revolts.

Government workers got a 4.6% raise this year. And 70mm Social Security recipients received an 8.7% benefit increase in 2023.

Such gains are mechanical, mathematical, removing the need for union strikes to extract more money.

The cost is simply added to the Federal deficit, which is funded through the issuance of bills and bonds, the supply of which is expanding at an accelerating rate.

Politicians can dampen the trajectory of this parabolic trend. Theoretically. In practice, they are the ones responsible for its remarkable shape.

And after six weeks of paralysis in the republican congress, a new House Speaker was selected, hailing from Louisiana, the 3rd most federally dependent state government in the union. Ahead of what will be the most chaotic presidential election in modern history, Mike Johnson will lead, having circulated an amicus brief - signed by more than 100 Republican lawmakers - and filed it in a Texas court case to contest the 2020 election results in four swing states.

It thus seems unlikely that our politicians will be focused in 2024 on restoring our national finances to a sustainable trajectory. There will be no Union boss to fight that fight. Only bond markets, which are ultimately built upon faith. And this is fading."

The full terms of the deal are unknown but we are President Biden will give it another 'thumbs up', because, after all, it's not his money.

Sur enough, President Biden just told reports, "I think it's great." Great for whom we are not 100% sure.

The United States is borrowing its way to disguise recession.

The headline economic figures for the United States look robust. However, details show concerning weaknesses.

Real GDP growth surged to 4.9% in the third quarter, above the consensus estimate of 4.5%. However, some analysts, including Bloomberg, expected up to 5% growth based on the nowcast estimates.

United States unemployment is also low, at 3.8%, but real wage growth remains negative, according to the Bureau of Labor Statistics. Between September 2022 and the same month of 2023, the decrease in real average weekly earnings was 0.1%. This means that a tight labor market is not improving the real disposable income of workers. Additionally, the labor participation rate and employment-to-population ratio remain below pre-pandemic levels. Add rising taxes to inflation, eating away at wage growth, and you can see why things are more complicated than what headlines suggest.

The cracks in the bullish story will appear soon. Consumer spending grew at a strong 4.0% annualized rate in the third quarter, which surprised most analysts after a weak 0.8% in the previous reading. The worrying fact is that this rise in consumption comes mostly from higher debt, as United States consumers are borrowing heavily to spend on entertainment. The rise in services was 3.6%, while real disposable income is negative (-0.1%) and household credit card debt reaches a new record. Unsurprisingly, credit card debt rose to a new high of more than $1 trillion, with the average consumer running a $5,900 debt on their card, according to the Federal Reserve Bank of New York. Last year, credit card interest rose to $105 billion, and this year will be much higher.

Americans are living on borrowed time as real salaries remain in negative territory in the past five years and inflation eats savings away. This may last, but not much.

More concerning figures in GDP: A strong economy does not show a decline in investment of this magnitude. Nonresidential business investment fell 0.1%, including a 3.8% slump in equipment investment. According to Morgan Stanley, capital expenditure plans have fallen to May 2020 levels.

The mirage of construction is also gone, as it fell to just 1.6% after a one-off double-digit increase in the past quarter. Furthermore, a large part of the growth in GDP came from bloated government spending financed with more debt and inventory revaluation, adding 0.8 and 1.4 percentage points to GDP growth. Many of these temporary effects will revert in the fourth quarter.

The level of public debt is exceedingly concerning. The increase in gross domestic product between the third quarter of 2022 and the same period of 2023 was a mere $414.3 billion, according to the Bureau of Economic Analysis, while the increase in public debt was $1.3 trillion ($32.3 to $33.6 trillion, according to the Treasury).

The United States is now in the worst year of growth, excluding public debt accumulation since the thirties.

Consumption financed by soaring credit card debt and economic growth disguised by enormous government spending and record public debt are not indicators of a strong economy but proof of a very worrying trend that may last another two quarters but will likely result in a much weaker economy in the next three years.

We start an extremely busy week for markets after a few major landmarks were reached on Friday which DB's Jim Reid felt are worth highlighting. The S&P 500 moved into "correction" territory, now down -10.27% from the July highs. Meanwhile the benchmark small-cap Russell 2000 index went through its June 2022 lows and back to levels last seen in November 2020, around the time that Pfizer announced the first successful Covid-19 vaccine trials. In fact, it's now back to levels it first breached in November 2018. When you factor in the huge inflation over this period, that's some serious real adjusted declines. So for all the optimism surrounding US equities this year it really is only a handful of huge companies that's skewing the positivity.

And speaking of companies skewing performance, if one strips away the Mag 7 stocks, the non-tech heavy SPW, NYA, CWI, RTY equity indices are now all at or below 200wma and down for the year.

The move into correction territory comes as we hit a very busy week of important central bank meetings, data, earnings and a fresh Treasury refunding announcement.

Over in Europe, the highlights will include the preliminary October CPIs and Q3 GDP reports for Germany today, followed by France, Italy and the Eurozone on Tuesday.

Earnings will be in full flow but with Apple on Thursday the highlight. The full day-by-day calendar is at the end as usual but let's preview the highlights in more detail now below.

In terms of payrolls, economists expect the headline to come in at 190k, down from +336k in September with the UAW strike causing around a 35k drag. They also see the unemployment rate remaining at 3.8%. There will be plenty of labor market data before hand with the ECI (tomorrow), JOLTS and ADP (Wednesday), claims (Thursday), and all the employment subcomponents within the PMI surveys.

German GDP today will likely see a -0.3% contraction (consensus -0.2%) with a mild contraction of -0.1% (consensus 0.0%) in the wider Euro area (tomorrow ). Our economists also expect the headline inflation measure for the Euro area to further decline to 3.1% from 4.3% in September, and see the core gauge slowing to 4.1% (4.5%).

Elsewhere, reports indicate Chinese officials may gather as early as today for the National Financial Work Conference that takes place once every five years behind closed doors. The real estate turmoil as well as other financial risks will be key discussion points.

Finally, on the earnings side, we are past peak earnings...