.. enter the ‘Cuban’ missile crisis, only this time it’s on steroids

With thanks to our own Colin Maxwell of New Zealand.

Please see: Part 1 ; Part 2 ; Part 3 ; Part 4

NB – AN EXPLANATION OF ACRONYMS/TERMS/ETC used in the article are listed at the end of this discussion piece.

1. Introduction

My sincere apologies for this delay in my sequel. I picked up a very nasty bug and at the same time experienced some major computer glitches.

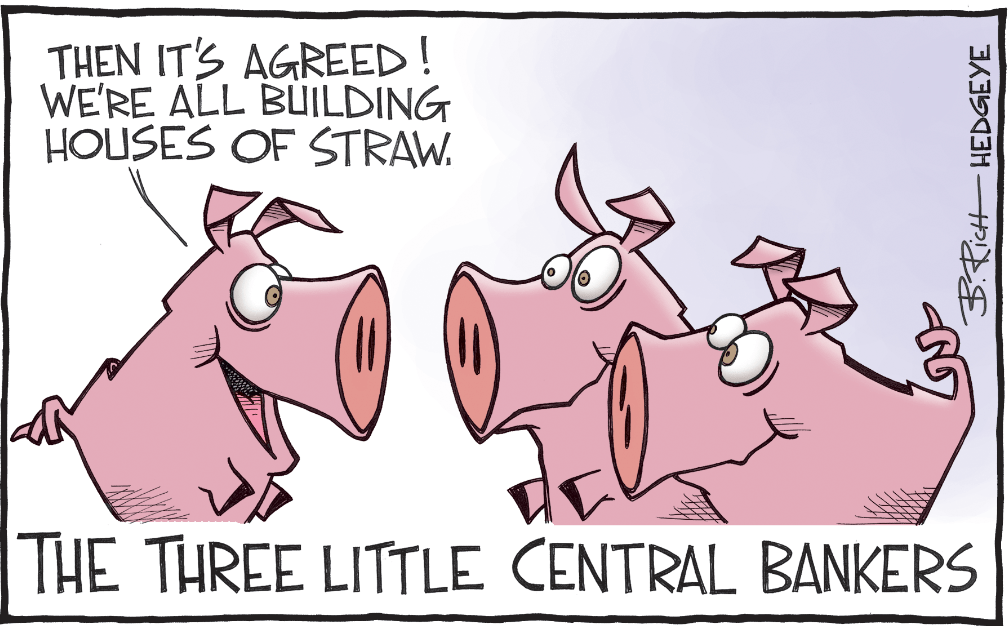

In the mean time it is my grim conclusion that the Western world won’t escape this gigantic financial hole it has dug for itself without going through a major systemic financial meltdown. Only with a tragic event will the critical mass of society actually rise up to demand the massive reform that is required to have any hope of recovering functional and sustainable economies.

I see no political escape from of the U$ train wreck (described earlier in eCONomics Part I) because the various components of the uni-party have almost identical financial and foreign policies. None of the POTUS candidates even bother to address the financial situation, let alone offer up any remotely workable solutions.

So too, history is massively against any hope of a successful independent POTUS, and the fact that RFK Jr is going to take votes from both sides of the ‘aisle’ means that IF the election actually takes place, Trump will be almost certainly be the winner.

This is despite the fact that he is a proven compulsive liar who still brags about his godfather role in the development of the experimental mRNA killer toxins. He also showed his true colours when he backstabbed Assange – whose published revelations paved the way for Trump to beat the truely dreadful and dangerous Hillary Clinton in 2016. What a truly sad commentary when a truly inept braggart like this is the only option available that would avoid a second term by the appalling ‘Crash Test Dummy’.

However, as the old cliche states – “seven days is a long time in politics” – however seven months is practically an eternity – especially given the dire financial situation and the multiple global military flash points.

Also, how soon could the pitchforks and riots manifest in the streets, and subsequently give the Biden camp the excuse they crave to declare Martial Law, in doing so creating the perfect opportunity to further tighten the noose on society’s freedom, by implementing a retail CBDC and it’s associated social credit controls?

The other possible titles I considered were…

KEEP PRINTING OR CRASH – nope, it’s keep printing and crash anyway.

IMMINENT GOLD REVALUATION – a worthy title too, as arguably this is the most significant single factor in a perfect storm of events that will be the end of the reign of the Western hegemon.

2. A Collision Of No Less Than Twelve Events In A Perfect Storm

#1 The Ukraine debacle exposing how utterly demented the U$ and NATOstan are in their hegemonic lust for control of resources, perpetual war and general mayhem. The comprehensive loss of yet another war is bad enough, but their attempts to hide this loss and extend the blood bath, makes NATOstan’s actions even more reprehensible.

#2 The Palestinian debacle – and Israel and the U$’s desire to genocide their population. The U$ and Israel play good cop, bad cop, whilst they carry on deliberate and overt genocide. Both countries have effectively torched the tiny skerrick of diplomatic capital they had left.

Many Palestians are already at level 5 starvation and yet this is being used as a weapon – even using aerial food drops as bait with Israeli troops stationed nearby with machine guns to gun them down as they try to retrieve food for their starving families.

#3 The build up in the tensions in the South China Sea and Warshington’s brazen prediction of a full scale war.

#4 The general weaponisation of the dollar and Western based payment systems.

#5 The idiotic 16,000 sanctions wrought on Russia – a reminder to the entire planet that this strategy doesn’t work – it only succeeds in providing a huge extra helping of bad karma for the voracious Western Hegemon.

#6 An announcement of a revaluation of gold by BRICS+ is imminent – as soon as this happens the Western fiat currencies will begin to implode – this as a corollary, with a return to hard backed currencies, may well turn out to be the single most crippling factor of all.

#7 The stability of the BRICS+ multiple commodity trade-only instrument will be

extremely compelling – not only will it be hard backed by gold, more than likely silver, and a host of other commodities (perhaps, as many as 20), but the smoothing effects of this system will come into effect and give countries the confidence to use it.

#8 The cooperative nature of the member nation’s currencies will encourage their use and an increasing percentage of trade will be done using swaps and bartering of goods for goods.

#9 Gresham’s Law will kick in – countries/people will liquidate their weak money and hold as reserves money which is regarded as strong and stable. This is when the exponential ramp up in hurt for the West will begin.

#10 The fact that it is almost impossible to miss the fact that Uncle $laughter has deliberately set about trying to destroy Europe – this gradual realisation by Mainstreet Europe, as the reality finally bites in, will never be lived down. Kissinger’s prophetic words should ring in the ears of the entire RoW.

#11 The absolutely disgraceful treatment of LatAm and the explicit Monroe Doctrine of raping this entire continent – and no more shocking example of the last century of atrocities than the sellout of the immensely resource rich Argentina by the utterly feckless Milei to Western imperial plutocrats. Refer – General Richardson’s recent visit to Buenos Aires – I just hope that our friend Jorges is travelling OK amongst all of this madness.

Second from left: the new Argentinian President ‘Mad Dog Javier Milei standing next to the archetypical neocon U$ Four Star General Richardson

#12 The highlighting of the centuries of the raping of the African Continent by Western Imperialism – the most recent and habitual protagonist being, you guessed it – Uncle $laughter.

3. Gold Stacking By The Global South

this constitutes the twilight of the fiat currency system

The World Bank reports that central banks bought 1037 tons of gold bullion in 2023, which is only slightly below the all time record set in 2022.

The astute entities, particularly in the ME and Asia are realising that keeping funds in U$ dollars is becoming too much of a liability.

Foreigners who own $14 trillion in stocks in the U$ and a further ~$8 triilion in treasuries are slowly waking up to the fact that they are not even the legal owners of this paper…. see eCONomics Part (I), section (iii) ‘The Great Taking’.

This stacking of bullion is enabled by the U$’s vain obsession of trying to protect the value of its currency. The Global South will continue to stack as the U$ facilitates the suppression of the real price with the COMEX.

It seems incredible, but the MSM has only just managed to figure out that the strength in gold is due to massive central bank buying. Apparently the casino house didn’t see these macro trends either – they were all to far too busy chart-painting and gambling to even look at the underlying fundamentals of why gold and silver were about to break out and head for the hills.

This subject was extensively covered in eCONomics Part (I) and so I won’t regurgitate it here.

Paraphrased from the one and only Alasdair Macleod…

“Money is the back stop of credit, which is why gold is so important. The dollar is not money, it is credit – it relies on the faith we have in the U$ Govt (oh dear!).

This is what is likely to come unstuck, as the entire colossal credit system begins to fall down around our ears.

Insurance has to be money in this event – not BitCoin, but gold. Silver has been demonetised, remaining very much an industrial metal controlled by industrial interests, particularly within China.

However, this control may well be slipping with the Indians buying so much silver, with deliveries on the COMEX this year over 1200 tons. As China loses control of the silver price its monetary characteristics will return.

When credit really does fall apart, people will go for anything tangible – obviously this does not include financial securities – in them there is no protection against inflation because they are in themselves credit which will get swept up in the collapse.”

Into the Maelström

4. Gold, Silver, or Bitcoin — which one(s) will Dah Fed concentrate on manipulating now?

Recently, the ‘cost to borrow’, meaning the cost to short sell GLD shares began to rise sharply from just under 40 BPS (0.4%) by almost 3x to a mind-numbing 1.06%.

Remember too that these borrowed shares ultimately have to be paid back as the price rises further the borrower is left in a ever deepening hole -who on earth would take this risk? – So who is the ‘who’ then? – it has to be dah Fed itself because no TBTF first tier bank compliance team would allow these huge high risk naked short bets to be made.

As the brilliant Andy Maguire recently stated – (paraphrased)…

“Why – because they are attempting to swamp the gold rally by adding borrowed supply in the hope that officials can repay these borrowed supply bets at a lower price. Yes we know that the Fed can print as much as they like, but this is all set to backfire spectacularly.

The Fed is the only remaining CB betting against a higher gold price and they are reduced to deploying the only tool in the tool box, which is using leveraged paper gold to try to chart paint the top of the rally.

Meanwhile, almost every other CB is swapping their excess dollars for physical gold and capitalising on being able to convert the COMEX synthetically driven supply prices into deliverable NSFR compliant bullion through the EFT mechanism. The Fed is now severely limited as to how many CTAs they can suck into puking up their long term bets to repay these GLD shares.”

The Fed is the only remaining global CB (dumb enough) to bet against a higher gold price and to use leveraged paper gold to continue to manipulate the price. Meanwhile any other CB, with half a brain, is swapping their excess dollars for physical gold.

Basically, available gold stocks have contracted ~50% in 4 years and many CTA positions are no longer rinse-able. The ringleaders now appear to be shifting their attention to injecting instability into Bitcoin, and phasing out gold and silver price fixing, as they become more and more badly burnt whilst the organic price discovery process advances.

Clearly, it is far more profitable to play around with cryptos than to have to eventually cough up gold bullion, which is ultimately NSFR compliant, and physically deliverable, leaving them in a deeper and deeper hole.

It is much easier just to print cash to bale themselves out, as their ability to print cash is virtually limitless – as opposed to eventually having to cough up physical gold that they don’t hold anyway.

5. Silver — massive extra demand for silver, notably in India and China.

We now witness an explosion in silver demand for use in the solar industry particularly in India, but it is strong in China too. India’s solar module production demand is likely to grow by ~60% by 2025.

This market requires thousands of extra tons, but the demand is also ramped up even further by the relatively higher price of gold – another perfect storm leading to unprecedented physical demand.

The extra thousands of tons of demand for silver will inevitably force the price much higher during 2024 – this cannot be contained by the bankster’s usual playbook of tricks.

Since the 1930s the gold to silver mining production ratio has stayed remarkably close to 8:1.

The Exeter Pyramid helps us to gain a perspective on how massively undervalued gold and silver bullion is relative to other financial assets and real estate.

When you look at the risk arrows which clearly indicate that there should be movement into gold and silver bullion, at the very least as an insurance hedge, it reveals just how huge the natural impending price discovery process could be.

Ownership of precious metals in the U$ are really only the equivalent of a pimple on an elephants arse – it represents the equivalent of a pitifull 0.5% of their assets.

As Andy Schectman points out – what happens when the population finally flicks up as to the extent of the great taking and if they advance their PM holdings to even a lowly 5%? – that alone would amount to a 10x increase in demand.

This is much like the COMEX debacle where the open interest is 1750% higher than the amount of bars held in their vaults. The dirty word is rehypothecation – meaning that most entities will have no access to physical gold, just as they won’t with silver.

The planned Moscow Metal Exchange could at any time set a relatively modest price for gold at $3000, and silver at say $50-$100. Just like that all of the Western markets could arbitrage straight to the East setting a real price – this would break the COMEX and the London Metal Exchange, and immediately break the dominance and the manipulation by the Western players.

6. Unsustainable Levels of Public Debt – the Destruction of the Middle Class

Daniel Lacalle wrote an excellent piece which was published on ZH April 9, 2024…

“When the fiscal position is unsustainable, the only way for the state to force the acceptance of its debt—newly created currency—is through coercion and repression.

A state’s debt is only an asset when the private sector values its solvency and uses it as a reserve. When the state imposes its insolvency on the economy, its bankruptcy manifests in the destruction of the purchasing power of the currency through inflation and the weakening of real wage purchasing capacity.

The state basically conducts a process of slow default on the economy through rising taxes and weakening the purchasing power of the currency, which leads to weaker growth and erosion of the middle class, the captive hostages of the currency issuer.

Of course, as the currency issuer, the state never acknowledges its imbalances and always blames inflation and weak growth on the private sector, exporters, other nations, and markets. Independent institutions must impose fiscal prudence to prevent a state from destroying the real economy. The state, through the monopoly of currency issuance and the imposition of law and regulation, will always pass on its imbalances to consumers and businesses, thinking it is for their own good.

The government deficit is not creating savings for the private economy. Savings in the real economy accept public debt as an asset when they perceive the currency issuer’s solvency to be reliable. When the government imposes it and disregards the functioning of the productive economy, positioning itself as the source of wealth, it undermines the very foundation it purports to protect: the standard of living for the average citizen.

Governments do not create reserves; their debt becomes a reserve only when the productive private sector economy within their political boundaries thrives and the public finances remain under control.

The state does show its insolvency, like any issuer, in the price of the I.O.U. it distributes, i.e., in the purchasing power of the currency. Public debt is artificial currency creation because the state does not create anything; it only administers the money it collects from the same productive private sector it is choking via taxes and inflation.

The United States debt started to become unsustainable when the Federal Reserve stopped defending the currency and paying attention to monetary aggregates to implement policies designed to disguise the rising cost of indebtedness from unbridled deficit spending.

Artificial currency creation is never neutral. It disproportionately benefits the first recipient of new currency, the government, and massively hurts the last recipients, real wages and deposit savings. It is a massive transfer of wealth from the productive economy and savers to the bureaucratic administration.

More units of public debt mean weaker productive growth, higher taxes, and more inflation in the future. All three are manifestations of a slow burn default.

So, if the state can impose its fiscal imbalances on us, how do we know if the debt it issues is unsustainable?

First, because of the units of GDP created, adding new units of public debt diminishes rapidly.

Second, the erosion of the currency’s purchasing power persists and accelerates.

Third, because productive investment and capital expenditure decline, employment may remain acceptable in the headlines, but real wages, productivity, and the ability of workers to make ends meet deteriorate rapidly.

Today’s narrative tries to tell us that nothing has happened when a lot has. This includes the destruction of the middle class and the deterioration of the small and medium enterprise fabric in favour of a rising bureaucratic administration that consumes higher taxes but still generates more debt and deficits. It does end badly. And all empires end the same way, with the assumption that nothing will happen.

The currency’s acceptance as a reserve does come to an end. The persistent erosion of purchasing power and declining confidence in the legally imposed “lowest risk asset” are some of the red flags some are willing to ignore, maybe because they live off other people’s taxes, or because they benefit from the destruction of the currency through asset inflation. Either way, it is profoundly anti-social and destructive, even if it is a slow detonation.

The fact that there are informed and intelligent investors who willingly ignore the red flags of weakening the middle class, declining purchasing power of the currency and deteriorating solvency and productivity shows why it is so dangerous to allow governments to maintain fiscal imprudence.

The reason why government money creation is so dangerous is because the government is always happy to increase its power over citizens and blame them for the problems its policies create, presenting itself as the solution.”

The CPI – what Rick Rule refers to as the CP LIE – doesn’t include food or fuel which makes it an utterly contrived index. Worse still, it does not even include taxes and yet this is the biggest expense of all – for many it is larger than food, shelter, energy and transportation combined.

Rick notes that for people like himself and the basket of goods he buys, and adding in taxes, it means he is losing around 7% per year on his money.

On a ten year treasury with a coupon value of say 4.1%, which sounds like one hell of a lot better than the 2.0% of days gone by, you are being scammed. If you work out the true rate, it is a disgraceful and debilitating negative 3.9% every year for 10 years compounded on your original investment.

Even the lower echelon within the Fed admit to Rick that the real inflation rate is far higher than what the public is led to believe – this means that there is absolutely no way that they could cut rates, because this would cause even more dramatic loses for depositors and bond holders.

Clearly, the institutional view within the Fed is to not reduce the rate, but within Congress there is a bipartisan desire to reduce rates and particularly within the Biden admin who desperately want to win the next election.

7. BRICS+10 — BRICS+16

onwards and upwards – this subject was discussed extensively back in eCONomics Part (III) of the sequel

Sergei Glazyev’s white paper has received the green light from the Kremlin’s Yuri Ushakov (Putin’s Assistant for Foreign policy) and will be presented to the Kazan summit May 14-19. I will try to do a proper update shortly after we hear the outcome of this important summit.

In the meantime the BRICS+ progress remains relentless, especially given that the BRICS+10 control the lion’s share of the global energy complex – the scale of the de-dollarisation process is poised to reach a completely new level. This is an utterly terrifying and self- inflicted situation that the Western hegemon finds itself in – they dug their own hole and are still digging.

We are now witnessing the creation of an immense socioeconomic-security bloc that will have more than 90% of global wealth and resources to back it up.

8. Don’t Blame COVID for the Looming Meltdown

— in fact the u$ economy was on the rocks well before any of us had even heard of covid – see the implosion of repo market in August 2019 on Trump’s watch.

Suffice to say the repo market that completely imploded on Trump’s watch when none of the banks trusted one another’s collateral any longer – even treasuries were not trusted any longer, as it became known that there could be multiple claims on them too. The repo market never recovered, and now sits at around $2 trillion as reverse repo – obviously the banks don’t want money on the street, and would rather hand it over to the Fed overnight.

Some of the big players see what is coming down the pipeline now too, and they are sucking PMs out of the exchanges.

NB – the U$ dollar is worth only 3 cents now compared to its value when the ‘Creature from Jekyll Island’ was incorporated. The next step is the road to a big fat ZERO cents worth, which is where all fiat ends up sooner or later.

There is also the opportunity for the PBS and FTT models to be deployed in sovereign countries where they can be introduced without hegemonic retribution and intimidation.

Within the BRICS+ block, it will be a case of letting 190 flowers bloom with the sharing of the success stories within so that the models that work in a particular set of circumstances can be embraced by other regions/countries with the confidence of them being already proven working models.

This would be an ongoing organic process that involves continued decentralisation and bottom up governance in a mix of cooperative endeavour that works to develop the real economy and to create permanent wealth for all of society, rather than just permanently feathering the nests of the parasitic financial casino economy.

I’m not going to label the new paradigm with any of the existing ism’s because this will be something completely novel. There should really be only one central maxim necessary – ‘treat others as you would wish to be treated yourself’ – that’s it!

The ongoing transition should be be a gradual orderly and organic evolution as new models prove their worth in the real world leading to a renaissance of the true human spirit.

9. The Hegemon’s Rapidly Deteriorating Financial State

On current trends the Biden Admin looks set to increase the existing debt of $34.5 trillion by $7.3 T to a mind-numbing $41.8 trillion.

If they could foist a retail CBDC on the country, then there are effectively no limits as to how low they can push interest rates. Negative rates could be invoked to eat up principle. Imagine that, when they have already destroyed 97% of the purchasing power of the dollar.

Using the existing commercial banks for the retail account doesn’t make CBDCs any more palatable as they would simply be using the commercial banks to distribute their policy, whilst achieving much the same effect as every man and his dog having a personal bank account at the Fed.

It is impossible for me to imagine any scenario where a retail CBDC is desirable

… but the absolute worst case is if it was administered as a retail account at the central bank in the case of the farcical Fed model, where that entity is 100% owned by a cartel of thieving and parasitic private banksters.

Even in a highly developed and extensive public utility banking system retail CBDCs would be a completely unworkable disaster. They would by definition, completely preclude a highly competitive banking system where a multitude of banks and models all compete with the result being beneficial interest rates and a high standard of customer services for society at large.

Retail CBDCs would be tantamount to the Soviet era Gosbank model where for ~70 years there was only one banking entity in the entire country. The result was as disastrous as it was predictable.

Even more alarming is the fact that the U$ FDIC is essentially trying to guarantee ~$20 trillion of deposits with a fund of a minuscule $121.8 billion – that amounts to a truly farcical 0.5 cents insurance on the dollar.

Even Bloomberg admits the fact that with $929 billion of CRE debt becoming due in the next 9.5 months, this could potentially topple hundreds of U$ banks.

10. BITCOIN — A Trojan Horse? — rolled out in during the Lehman debacle

QE started then – TPTB endeavoured to have everything looking as normal as possible so that the public was oblivious to what was going on.

As a rule people who go for gold, silver, and cryptos have the same wish – ie, to operate outside the main system, but does bitcoin really belong in that category?

Surely bringing in a Bitcoin ETF is rendering it into the casino system anyway. Initially they were very appealing to the libertarian who sees the debasement of fiat and is looking for an alternative – but aren’t crypto currencies technically fiat anyway? This is made even more precarious when there are ~10,000 different crypto currencies.

Perhaps we all need to consider the fact that this might have been a cunning plan to get digital currencies out and about in the public domain and normalised in the minds of society at large.

Who was Satoshi Nakamoto anyway, the so-called author of the original white paper and who devised the first blockchain database? Supposedly the work began in the second quarter of 2007, and the domain name bitcoin.org was registered in August 2008.

He allegedly continued in the development of the software until mid-2010 before handing over control of the source code depository and domains to various entities, ending his recognised personal involvement in the project.

According to Wiki, Nakamoto had some $73 billion worth of Bitcoin in 2021, making him the 15th richest person on the planet.

Given that the Japanese term ‘satoshi’ can mean ‘intelligent’ and ‘nakamoto’, ‘central’ was there a playful suggestion behind the name as to who was really behind the scene – ‘Central Intelligence’? – what a horrible thought.

Is this just another ploy to keep money from going into gold and silver and exposing yet another dying fiat currency.

https://m.youtube.com/watch?v=lBo_mVV81n8

11. mRNA Toxins — Another Extremely Bearish Factor

The massive rate of toxic mRNA jabs deployed in Western counties is an extremely depressing subject, but it would be remiss to not mention this as another giant debacle that will help seal the hegemon’s fate and virtually guarantee a debilitating debt death spiral for much of the West

Ed Dowd’s numbers suggest that globally ~ 2.2 billion people have been either killed or are permanently disabled by the toxic jab roll-out – that’s the same one that Trump still brags about.

97% of the US military were jabbed and their own data shows cancer rates are up ~1000%. Heart disease is up 970% in the US military.

In the UK, 18-39 year olds, jabbed 4 times are 318% more likely to die than their unjabbed contemporary control group.

The German Govt recently admitted that there was no pandemic and that figures demonstrate that the fully jabbed on average surrender 25 years of their life.

In the U$, CDC data revealed that each jab increased mortality by 7%.

Highly jabbed regions showed ~15% higher mortality than 2021.

Highly jabbed regions showed ~15% higher mortality than 2021.

2 doses and 3 boosted were 35% more likely to die in 2022 than 2021.

2 doses and 3 boosted were 35% more likely to die in 2022 than 2021.

By contrast, the unjabbed were no more likely to die in 2022 than 2021.

By contrast, the unjabbed were no more likely to die in 2022 than 2021.

This will have a disastrous effect on productivity, as not only is the fully productive work force dramatically depleted, but the care of the seriously jab injured will soak up even more labour resources and other expenses.

12. Wrap Up

Oh, and I just located some good news, albeit though, very much confined to the Global South realm. There is a much lower level of debt in the RoW and developing economies, compared to the ravenous NATOstan – it is completely self evident even within the figures released by that dreadful IMF creature…

2022 IMF DATA – % of debt to GDP

World 238%

World 238%

Advanced’ economies 277%

Advanced’ economies 277%

Euro Area 254%

Euro Area 254%

UK 252%

UK 252%

U$ 273%

U$ 273%

Emerging market economies 191%

Emerging market economies 191%

Others 124%

Others 124%

Low income developing countries 88%

Low income developing countries 88%

In fact this debt could become almost negligible if the BRICS+ in unison, gave the economic Western hitmen the middle finger salute in all cases where they have made deliberately cynical, unpayable, and predatory loans in the first place.

The new socio-economic paradigm will be premised on cooperative goodwill and mutual progress for all participating countries. In this blueprint a minimum of resources will be spent on killing one another, and member nations will enjoy the security provided by an immense bloc that has more than 90% of global wealth and resources to back it up.

There is also the opportunity for the PBS and FTT models to be deployed in sovereign countries where they can be introduced without retribution from the hegemon – the fiscal and monetary aspects of this model were covered in eCONomics Part II.

Within the block it could be a case of letting 190 flowers bloom with the sharing of the success stories within the group, so that the models that work in a particular set of circumstances can be embraced by other regions/countries with the confidence of them being already proven working models.

This would be an ongoing organic process that involves continued decentralisation and bottom up governance in a mix of cooperative endeavour that works to develop the real economy in order to create permanent wealth for all of society – rather than just permanently feathering the nests of the shadowy figures ensconced behind the parasitic financial casino economy.

I’m not going to label the new paradigm with any of the existing ism’s because it will be something completely novel. There should be only one central maxim necessary – ‘treat others as you would wish to be treated yourself’ – that’s it!

Fingers and toes all crossed, the ongoing transition should be be a gradual orderly and organic evolution, as new models prove their worth in the real world in a monumental transition and a complete renaissance of the very essence of the true human spirit.

And how prophetic were the words of the great Leonard Cohen (my all time favourite Canadian, my friend Emerson) in his epic song ‘Anthem’ which took him some 10 years to complete.

Verse 5 nails what is happening right now, as a torrent of countries clamour join the BRICS+ juggernaut…

You can add up the parts

You won’t have the sum

You can strike up the march

There is no drum

Every heart

Every heart to love will come

But like a refugee

Such a tragedy that this great man passed and never got to see this massive event beginning to unfold.

— strap on a good quality headset, crank up the volume, and accompany Cohen on an incredible journey.

Colin Maxwell – April 11, 2024

EXPLANATION OF ACRONYMS/TERMS/JARGON used in the article…

AKA = Also Known As

CB = Central Bank

CTA = Commodity Trade Advisor

COMEX = The Commodity Exchange Inc. = the world’s leading derivatives marketplace for trading metals – formed 50 years ago specifically to rig gold and silver prices, to try to protect Western fiat currencies

CPI = Consumer Price Index

CTA = Commodity Trade Advisor

ETF = Exchange Traded Funds

EFP = Exchange of Futures for Physical

Global South = all countries apart from NATOstan = AKA RoW

GLD = the SPDR EFT gold share Nasdaq ticker/symbol

NSFR = Net Stable Funding Ratio

NATO = North Atlantic ‘Terror’ Organisation

NATOstan = NATO plus its yapping lapdogs and sundry hangers on – sadly this group includes both NZ and Australia

Repo = Repurchase Agreement – a form of short term (often overnight) form of borrowing for dealers in government securities

Reverse Repos = the reverse of a Repo – it is the party originally buying the security

Rinse-able = this term refers to investors that can be lured out of their long positions

RoW = Rest of the World

SPDR = one of the family of ETFs managed by State Street, the TBTF largest asset manager on the planet with around $44 trillion in assets under management, custody and administration – it tracks the price of gold bullion in the over-the counter market – the SPDR gold share ETF is known as GLD

TPTB = The Powers That Be

In this part: Interest rates manipulation as a way of tackling inflation — one of the most shocking financial scams of all time; plus an update on de-dollarisation and No Plan B for Uncle $laughter

With thanks to our own Colin Maxwell of New Zealand.

Please see: Part 1 ; Part 2 ; Part 3

The duck shooter’s clubhouse on Jekyll Island, Georgia, United States of America

Introduction

It should be of no shock to any of us by now as to the reason WW1 began a very short time after the U$ Fed was incorporated, and this set the tragic pattern for the next 111 years. This tiny group of bankster plutocrats were handed on a plate by Congress a giant counterfeit printing press – a privilege that these thieves would deploy to progressively impoverish the working classes of most of the planet.

I won’t go into this too deeply here as I covered the background of the Frankenstein-like creature from Jekyll Island in the link below – my April 2022 expose’, and the debilitating effect this dreadful bankster construct has had on the global financial scene ever since:

It remains my life’s mission to expose the fact that the Western central banking industry, and its plutocratic owners operating in the shadows, are the head of the human food chain and the underwriters of more than 90% of humanity’s wars, terrorism, and financial impoverishment.

The great news though is that humanity is being thrown a lifeline by the BRICS+/BRI blocs and their related initiatives. Indeed all we have to do is to summon up the presence of mind to recognise this new reality and to reach out and grab the opportunity with both hands. The background of this new global paradigm was explored in Part III of this sequel –

The solution will be multi-faceted as it will involve a new global paradigm – never again will a single national currency have dominance – the new system will include a novel trade-only settlement instrument which will be stable, hard backed, and yet still able to provide adequate liquidity for the participating members’ productive economies.

In reality, WW1 never ended – WW2 was a follow-on with a brief respite of barely one generation in between, paving the way for the future hybrid financial, and techno, forever-wars. These, including the COVID debacle and the great poisoning with chemicals and pharmaceutical toxins, are simply a continuation of the same families pulling the strings from the shadows.

This is the business of human butchery and their intentions are becoming more explicit and outrageous as each decade passes by. In every sense of the word, this plutocratic network is a blatant terrorist organisation and needs to be dealt with accordingly. The rules of engagement should be the same and history reminds us that the only sure-fire way to deal with organisations like this is to permanently cut off their funding.

Because the New York Fed is the most outrageous model ever devised and has become the number one money spigot of the globe, this is precisely the place to start. This has never been more urgent as it is painfully obvious that there is a push for another bank run crisis which the owners of the banking cartel think will give them the crisis excuse to usher in a new retail central bank digital currency (CBDC) system where every man and his dog can have an account within the “Federal Reserve” system. This is their grand plan, which if successful would give the commercial banking cartel total control of every aspect of our lives through a social credit control and tracking system of all retail account holders.

Prof Richard A. Werner of the University of Winchester

1. Professor Richard Werner

“empirical evidence is that interest rates are a lagging indicator and a farcically ineffective monetary tool”

paraphrased/quoted from… https://soranomics.com/#content_20_fancybox-8

As Werner points out, it is not interest rates, but bank credit that determines economic growth, simply because ~97% of the money supply in our Western fiat currencies is created out of thin air by privately owned commercial banks.

There is zero basis for the official narrative that higher interest rates lead to lower growth and that low interest rates lead to high growth.

As with most aspects of eCONomics the quickest way to get straight to the truth is to simply assume the 180˚ polar opposite of the official narratives. Interest rates are simply not useful as a monetary policy tool – PERIOD! (23:30)

Interest rates actually follow growth – so where on earth did this idea come from that interest rates are this key variable? – it is not based on empirical evidence but on the concept of equilibrium which is based on no less than 8 assumptions none of which hold up in the real world…

(29:00) The methodology in Economics is the Deductive Method – reverse engineering AKA Charlatanism.

2. eCONomics

eCONomics — the pioneer pseudo-science that paved the way for other disciplines to follow as a tool of central planning and globalist agendas

Karl Popper

Karl Popper called this the ‘immunising stratagem’ which scientists fancied could guard their theories from being challenged by the use of reverse engineering in what became known as the ‘deductive approach.’ This is my interpretation of the process…

3. How high would hikes need to go to arrest inflation?

High enough that they cripple the real economy before there is any ‘measurable effect’ (sic) on what they labelled ‘inflation’

Poet Lawrence Ferlinghetti asked… “whether man must burn down his house to roast his pig…”

The current Western neo-classical monetary policy used to tackle inflation is precisely that scenario.

Worse still, history illustrates that interest rate hikes have to be so utterly brutal that they need to be at the very least at the level of the true inflation rate, or higher – Paul Volker did this in the 1980s when the rates were pushed above 20%. This was construed as successful from the point of view that it appeared to halt inflation when all it had done was destroy enough of the economy and liquidity to make sure ‘inflation’ was halted.

Ronny Raygun with Paul Volcker – confirmed in 1979 by the Senate as Fed Chair

In 1979 the federal funds rate had averaged 11.2% and Volker took them to a peak of 20% in March 1980. The prime rate topped out at 21.5% in 1981, which heralded (surprise, surprise, NOT) a rise in unemployment to over 10% and the 1980-1982 depression.

“Volcker’s Federal Reserve board elicited the strongest political attacks and most widespread protests in the history of the Federal Reserve (unlike any protests experienced since 1922), due to the effects of high-interest rates on the construction, farming, and industrial sectors, culminating in indebted farmers driving their tractors into Washington, D.C. and blockading the Eccles Building.

US monetary policy eased in 1982, helping lead to a resumption of economic growth.”… Wiki quote.

Although I am a great admirer of Ron Paul – IMO the quote below reveals that even he was not aware of the utter falsehood of attempting to use rate hikes as a constructive monetary tool to address inflation.

“Being in Congress in the late 1970s and early 1980s and serving on the House Banking Committee, I met and got to question several Federal Reserve chairmen: Arthur Burns, G. William Miller, and Paul Volcker. Of the three, I had the most interaction with Volcker. He was more personable and smarter than the others, including the more recent board chairmen Alan Greenspan and Ben Bernanke.”

Volcker may well have been smartest, but in my opinion all three wreaked havoc on Mainstreet and massively rewarded the financial economy at the expense of families, SMEs, and the productive economy. As Volcker aged, he became more critical of the banking industry but that was long after he had spent his career indulging and implementing most of the destructive hoaxes of neo-classical eCONomics.

Other features of Volcker’s career…

SUMMARY: interest rate hikes are not an effective monetary tool to address inflation – on the contrary, they instantly feed inflation just as hikes in energy prices do – you do not even require the most basic economic nouse to understand this principle – it should be self-evident to anyone with an IQ even approaching room temperature.

4. Safe Havens in times of financial strife – where are they now?

In the 1980s the level of total debt was so much less than it is now that the entire financial meltdown was at a totally different level. Today just the Govt debt alone is a death spiral in itself, with an extra $1 trillion added every 100 days.

In 2024 the U$ will have to issue $10 Trillion in Treasury paper to finance more deficits and to roll over old paper at much higher interest rates. The revised cost of this debt will rise from ~$1 Trillion to $1.5 Trillion. This is a debt spiral where more and more money has to be borrowed just to pay the interest back – paying down debt is not even on the radar.

All of the big 5 Western fiat currencies have this problem including the three sometimes referred to as ‘default currencies’ – the dollar, the Yen, and the Swiss Franc – these used to be seen as safe havens to hide when the financial/geopolitical shite hit the fan. Now none of these are safe any longer, and so the pressure will really come onto these currencies as there are now viable alternatives that countries can use in their accelerating de-dollarisation strategies – these include…

To me the Western safe havens no longer exist, as the main Western fiat currency economies now face a very unpleasant binary choice between either…

A. Severe hyper-inflationary depression, or

B. Severe and extended debt liquidating depression

5. A tribute to Pepe Escobar’s recent work in Russia

What a privilege for us all to have such direct access to Pepe’s insights. I regard him as the undisputed global high priest in terms of geopolitical analysis and journalism. I am most certainly not alone in this view, judging by the audiences he pulls in terms of readers and interviews with people of note in this fight for multi-polarity and who are involved in developing the architecture of a new paradigm in global socio-economic methods and relations.

His audience with Glazyev, whom I have enormous respect for as an honest and courageous economist, was particularly intriguing, and not the least because some of the revelations were done off the record. My own personal hypothesis is that the entire development of the new trade instrument is making great progress, but that there is no point in rushing the announcement of the final details, as long as there is still ample opportunity for BRICS+ countries to gold stack… see above chapter (4) first bullet point.

Of course, this opportunity is entirely courtesy of the U$ obsession with massively shorting gold in this pathetic attempt to hide the plummeting purchasing power of their currency. It could be any day now when an entity insists on a large physical tonnage and the physically driven price discovery process begins. When that happens the gold price will break out and it will be time for the various player’s hands to finally be revealed.

In the meantime, the RoW carries on carefully checking out further de-dollarisation strategies and putting the finishing touches on the new trade instrument. As I said previously, the BRICS+ bloc has an enormously strong hand, whilst all the West has is the grim reality of an impending debt spiral.

Glazyev sees the next stage as detaching commodity prices from the dollar and quoting them in other units. This involves the new model based on two different baskets – a basket of currencies of member countries, and also a basket of exchange commodities. The fact that this currency will be so inherently stable will make it more attractive than the dollar, the pound or the euro.

Technically the trade currency instrument is almost ready, and the process only requires the political will and acceptance by India and China. In the meantime, the transition to settlements in national currencies is well underway.

The trade instrument will be backed not only by the national currencies but by the huge reserves of the nominated commodities that combine to back up the new international settlement currency. This new currency is not a substitute for national currencies.

Once all of the technical issues are finalised, they will prepare an international treaty that will be open to accession by all other countries wanting to join. Glazyev is clearly in no hurry and has put a time frame of within 2 years from when he made these announcements back in late October 2023.

Gazyev listed these advantages…

5. SUMMARY – The long and the short – literally!

None of this reality is being addressed by Uncle Slaughter and clearly, they have no plan B. A giveaway is the fact that actual military spending for 2022 ended up at a mind-boggling $1.537 Trillion – more than twice the publicly acknowledged level. If nominal GDP is around that $20 trillion then that military budget is a truly obscene 7% of GDP, and equal to more than the next 40 biggest spenders combined.

In fact, the next 40 countries spending totalled $1.431 trillion – some $100 billion short of the U$’s $1.537T and with Romania coming in at #39 in the list at $5.2 billion, it could well be the equivalent of the combined 60 or more highest military spenders.

I eventually got sick of adding and gave it up – besides, I was in dire need of a wee dram.

Colin Maxwell

( March 12, 2024)

A New Global Trade Currency Paradigm and the End of the Era of Dominant Western-based Fiat Currencies

With thanks to our own Colin Maxwell of New Zealand.

Please read in order: Part 1 ; Part 2

Preamble

My apologies in advance to the vibrant GS community for Part III being so wordy. I have really struggled with this task, as the entire subject is so monumental in all of its interconnected elements.

To try to avoid it becoming too tedious I have broken it down into multiple chapters to try to make the weight of the subject matter a bit more palatable, and to hopefully avoid losing readers within the first few paragraphs.

None of this is intended as gospel or sermon, but simply as a discussion document that endeavours to pull together as many of the current contrasting thought threads as possible.

It is also part of my own personal intellectual journey, and extremely steep learning curve. I learn the most by writing on subject matter like this.

Critique and suggestions are very much welcomed.

1. Operation Sandman – to use or not to use?

In 2022 the Saudi MOF revealed in a WEF/Davos interview that ‘Operation Sandman’ was activated and that the KSA would now gladly accept all currencies for settling oil transactions.

The theory was that when it is properly launched, at least 100 countries would conduct a coordinated sell off of their trillions of dollars worth of US government debt to break the U$ dominance of the global economy. This would immediately open the door for a completely new financial hierarchy.

According to Stephen Jen, CE of Eurizon SLJ Capital, the share of global reserves held in U$ dollars eroded in 2022 at 10x the average pace of the last 20 years, and stood at 47% – a much lower estimate than that of the IMF. This represents a plunge, especially in relation to the 15 year trend.

Multiple factors include…

<< *This was effectively a move from Tier 3 class for commercial banks holding it as an asset on their balance sheets. The BCBS (Basel Committee for Bank Supervision) is arguably the highest global authority on banking supervision, with the key role of defining capital requirements.

Ironically with the latest developments with the BRICS+ bloc and the revelations of just how precarious some of the Western fiat countries are in being underpinned by their ability to sell government bonds, the new physical gold Tier 1 designation could really put the skids under this entire fiat edifice.

Prior to this new ruling, banks were very much dis-incentivised to hold gold, and instead to hold risky assets such as equity capital, currencies, and debt instruments. IMO opinion the fiat currencies carry significant risk already, let alone when the new hard backed BRICS+ instrument comes into play. >>

This erosion of support for the existing reserve main currencies will inevitably lead to…

2. Why I doubt that Operation Sandman will be invoked…

a crucial historical review

It is a pointless exercise and counterproductive for the entire planet, including the BRICS+, and the RoW to do this in unison. They can all simply gradually dedollarise by stealth, and in doing so maximise the benefits whilst transitioning in an orderly fashion.

Besides, the US is massively naked shorting gold anyway, in the vain hope of hiding the massively eroding purchasing power of king dollar. This is a godsend for the RoW central banks – the US is idiotically accommodating their rival’s gold bullion stacking binge at massively discounted and contrived synthetic prices – they must be laughing all the way to their central banks.

For more than half a century, since Nixon took the dollar off the international gold standard, all currencies became fiat. Prior to that event, they all were hard backed and most of all by that barbarous relic, gold. The way things are panning out the 50 year experiment of a non hardbacked reserve currency is coming to a close very soon. In the context of some 5000 years of financial history this is barely a drop in the bucket.

Essentially, from 1971 on, there was a divergence of investment in the U$, and many other Western financial systems, away from the industrial capitalism of the real world economy, into what would turn out to be ruinous financial capitalism. Surely fiat currencies, coupled with a greedy obsession with financial rentier capitalism, is a guaranteed recipe for disaster.

3. Is The U$ Pinning its Hopes On Discovering Alchemy?

Europe’s tiny central bank gold holdings are probably accurate and likely not rehypothecated to any great extent, but the same cannot be said for the US’s claimed 8133 tons of US gold holdings.

It is almost certain that there are multiple ownership claims on each ounce, and this is why global central banks are quietly repatriating physical bullion. The same with silver, as the paper claims for each physical ounce are at least 90:1. The silver price discovery market is even more broken with the true G:S ratio needing to be more in the realms of between 8 -16:1.

Texas is very wisely building its permanent state depository and recategorising gold as legal tender. They do not trust the centralised system, and now at least six other states are looking to follow their lead, because they too are losing trust in the federal system, and in the management of US Treasury gold.

If Texas doesn’t trust the U$ system, then why on earth would the RoW?

4. Foreign Exchange Reserves Quietly Converted Into Gold Bars

It turns out that the massive global shadow banking industry, and with gold being auto-categorised as foreign exchange reserve, that this combination has hidden the fact that large swaths of foreign exchange reserves are being converted into physical gold.

This trend dates back to at least 2010 but really ramped up when the US weaponised the dollar in March 2022 with Russia’s SMO in Ukraine.

This makes a ton of sense (literally) for the RoW, as it amounts to de-dollarisation by stealth – converting incumbent US dollar debt into stacks of debt-free bullion.

Furthermore, this sanction-proofs potentially trillions of excess reserves – a no-brainer when the entire globe is in such a state of financial and military turmoil.

Estimates are that China has around $6 trillion in excess FX reserves giving a truly staggering gold/GDP ratio compared to Europe with a pitiful 4% average and the US potentially massively negative.

Robert Triffin, Belgian-American economist (1911–1993)

5. Another new Global Paradigm — no national currency having the ‘exorbitant privilege’ of reserve currency status

indeed a first for humanity…

Why on earth would any country, especially China, want its currency to have overwhelming reserve currency status anyway? A very bright spark, Robert Triffin, predicted back in 1959 that the Bretton woods system, with the U$ dollar as the world’s utterly dominant reserve currency, was doomed because of fundamental flaws.

Triffin was right – the Belgian born Yale professor predicted that by definition a reserve currency would run increasing deficits. The more popular a reserve currency is, the higher its exchange rate tends to be and the less competitive its domestic exporting industries become.

This means trade deficits for the country issuing the currency. They love the effectively ‘interest free loan’ generated by selling their currency, or in essence their debt, to other countries, but at the same time they need to raise capital for dollar denominated bonds. This is part of the paradox – cheap sources of capital and positive trade balances rarely coincide.

6. Implications of Gold Backing – a national currency versus a trade only international instrument

History has proven that gold is inappropriate for domestic monetary backing. Michael Hudson covered this on page 433 of his epic book ‘Super Imperialism‘ quoted/paraphrased…

‘Freeing domestic credit from gold backing has been a precondition for promoting rising employment and production of goods and services. But in the international setting gold backing is a positive because it serves as a very real constraint on trade imbalances but not on domestic production and employment.

You could say that Europe and Japan abandoned gold prematurely before developing an alternative to the U$ dollar or the dollar-proxy SDRs issued by the IMF, as an effective arm of the U$ government.

Only the U$ has shown the will to create international structures, and to restructure them to fit its financial ‘needs’ as they devolved from a hyper-creditor to a hyper-debtor nation.

Removing the gold convertibility of the dollar enabled them to unilaterally pursue protectionist trade and cold war military practices simultaneously. The US claim that their surplus dollars act as a ‘growth locomotive’ for other countries by expanding their credit creating powers – as if they need US dollars to do this.

Meanwhile they were able to derail foreign attempts to break free from what has become a tidal wave of US deficit dollars. History will reflect on the remarkable asymmetry between the U$ and the RoW.” … end quote.

Of course public utility models, like the incredibly successful Commonwealth Bank of Australia, prove that assumption to be patently and tragically false, as this model went on to be arguably the most successful public utility equivalent to a reserve bank in world history.

7. The Commonwealth Bank of Australia — a Pubic Banking Utility Masterstroke

I have included this long chapter, because it is actually an integral part of this entire subject of eCONomics – which is to say that everything about neo-classical economics is based on false maxims and lies, designed to enrich the financial kleptocrats ensconced at the head of the human food chain.

This is integral because it illustrates the fact that in so many cases countries do not even need to borrow from abroad if they effectively deploy the PBS at reserve bank or treasury level. This is another key piece in the global jigsaw puzzle where the global economy could be transformed into a completely new egalitarian paradigm.

The public banking model in itself would become a huge source of liquidity and capital for the entire domestic economy. This would replace the status quo con where nations allow a parasitic global banking cabal to constantly thieve from them like a giant squid, sucking the lifeblood out of the entire nation.

This concept is extremely simple – it means that the public creates their own money and liquidity and to reap the benefits of any interest paid domestically, rather than third parties creating that money and subsequently allowing them to charge us as a nation for that privilege. In the current broken model, we annually allow billions of dollars to disappear overseas into these parasitic global banking institutions.

The exciting part of it all this is that incredibly successful public banking utility models have already been tried and proven to work, and to generate huge sustainable wealth for entire national economies.

One of the most stunning examples was the Commonwealth Bank of Australia which Ellen Brown details in her awesome book ‘The Public Bank Solution‘. Of course, history informs us of the tragedy that this incredible model didn’t last – it actually became a victim of its own astonishing success, and it was destroyed by the combined might of the parasitic global central banking cartel.

While the US was setting up its privately owned central bank, for the Federal Reserve, to become a parasite on the productive economy of most of the world, Australia was at the exact same time taking the bold step of establishing a PBS bank that issued credit for the sole benefit of – wait for it – Australians!

The huge irony is that Denison Miller, the bank’s first Governor, was allowed to try this model only because he was considered by the other existing bankers of the day to be one of their own thieving ilk, and that therefore they would be able to keep this new bank in line.

In essence, Miller understood how the commercial banks thieved from the nation at large and he set about creating this new model that could very rapidly revive a struggling economy and create long-term wealth for the entire Australian society. The first branch opened in Melbourne in July 1912 and Miller was the only employee.

Somehow he had persuaded the Treasury to advance him £10,000 as seeding money – the first and last time this version of the CBA was lent any money. Of course, this money didn’t even exist – it was simply created as a ledger entry.

Miller subsequently promised that the CBA would at all times be the people’s bank. It slowly dawned on the private bankers, who were so intent on having to guard against the socialisation of their own banks, that they completely underestimated the power of an orthodox banker who simply mobilised the resources of the entire country to enable the CBA to quickly grow into one of the greatest banking models the world had ever seen.

The bank began advancing massive sums of money simply on the credit of the Australian Nation. An early example was the Melbourne Board of Works which went to the market for money to redeem existing loans and to raise new capital – normally they relied on loans from the viper’s nest residing in The City of London. Instead, this time they approached Dennison Miller and were loaned £3 million at 4% – this was an enormous sum at that time.

In 1914 during WW1, citizens started rushing into their banks to withdraw their funds – Miller quickly put a stop to these bank runs by simply declaring that the CBA would support any banks in difficulty – that was the end of the panic immediately. It was a dramatic demonstration of the power of the Govt to stabilise the financial system without relying on any other parties.

In just 2 years from the creation of this bank, Miller was basically in control of financing Australia’s war effort and ZERO money was borrowed from overseas. It was the first bank in Australia to receive a Federal Govt guarantee and offered both savings and general transactional services. By 1912 it took over the State Savings Bank of Tasmania, and by the following year, it had branches in all 6 states.

In 1920 it began acquiring central bank powers and took over the responsibility of issuing Australian bank notes from the Dept of the Treasury. In 1924 a board was appointed with 6 members as the new governing body. During WW2 emergency legislation was passed and the CBA was granted almost full central bank powers.

The CBA was a remarkable success, but was subsequently seen to be threatening the hegemony of the City of London thieves. Prior to the establishment of the CBA, London capital had always dominated the Australian financial system.

This was the colonial model of the time – ie financial colonialism, where the colonies were granted the right to “govern” themselves – provided they obeyed the financial rules of the COL (City of London) – shame about this acronym!. As such the Old Lady of Threadneedle Street (The Bank of England) presided over the financial dynasty of the empire.

Australia was a debtor nation until WW1 when it suddenly demonstrated its ability to independently finance its war effort. It also used the CBA to finance its own shipping line which was poised to smash the City’s shipping monopoly – the old bitch from Threadneedle Street was not amused.

Miller calmly told the big bankers at a dinner in London that Australia could meet any demand, simply because it had the capital of the entire country behind it. When he arrived home in Aus he was asked by a deputation of the unemployed for a loan of £350 million for productive purposes – he advanced the money immediately, and news of this caused panic within the COL, as they realised that if other countries adopted this model their entire financial edifice could collapse.

The COL immediately set about devising a plan that would enable overseas national institutions to be drawn into its squid-like network. The plan was to centralise all banking throughout the empire over to the supervision of the Bank of England – it would become the super banker’s bank.

The horrible old lady got her way and as such the modern parasitic and hegemonic central banking model was born. The head of the bloodsucking squid would eventually moved from London to the Bank for International Settlements (BIS) in Basel Switzerland – a model originally designed to launder Nazi war loot pilfered from their rampage across Europe during WW2.

This is the disgustingly parasitic model that survives to this day, and New Zealand (NZ) is a paid-up member of this bankster club too – our RBNZ dances to their tune and as a result we squander billions of dollars annually overseas to thieving institutions when we could create our own money and credit just as the CBA did in Australia.

Sergey Glazyev, Russian politician and economist, with Vladimir Putin

8. Whats is the new BRICS+ Instrument to be – a basket of 20 commodities including gold, or gold alone?

Some very astute financial analysts, including Alasdair Macleod have thought all along that Sergey Glazyev, the Commissioner for Integration and Macroeconomics within the Eurasian Economic Commission, the executive body of the Eurasian Economic Union, was never that serious about the new trade instrument being backed by a basket of around 20 major commodities including gold and silver.

Their theory was that this multiple hard-backing would be too hard to bring to fruition and to administer. Personally, I always liked the idea because I thought it could have had a smoothing effect on the volatility of the trade instrument. This would be very much the case until the market discovery of G & S finally kicked in to properly expose the true purchasing power of the dominant Western fiat currencies.

Certainly though, the gold only backing could be easily instigated, with a brand new issuer of this currency that would not be taking a central bank style role, but to simply become an institute of issuance.

Gazyev has publicly written in a Moscow based business paper that it is time for the Russian rouble to be on a gold standard – given this was co-written by the deputy of the EUEA Committee, this must carry some weight, but it was written back before the Johannesburg BRICS+ Summit meeting, in which no decision or announcement was made about the new instrument.

Also at that time there were statements from Indian officials that there was no way they would go along with this gold-backed currency. Remember too that BRICS+ requires a unanimous vote for this new currency instrument to be accepted.

Also Lavrov has mentioned that Russia had accumulated a large quantity of Indian rupees which were difficult to convert – a new trade instrument would make the process of trade a breeze, and stop the third party ticket clipping too. No sooner was this intent announced than both the odious Yellen and Kissinger visited Beijing to try to pressure China from joining in this new initiative, presumerably using the argument that it would undermine their export market.

It appears that China is more concerned about the vulnerability of the new BRICS+ members stress arising from high interest rate loans, than they are about the welfare of the Western hegemon – who could blame them for that – the economic hybrid war waged against the RoW is hardly a secret.

Also the new trade-only currency is very different from normal bank credit, as this form of credit is self-extinguishing when trades are completed. I assume the importer would get access to the trade currency through its central bank. This would be credit created on the back of this new currency and tied to gold, not just created out of thin air.

Presumably this would make the politics a lot more simple because there would be no interference with the management of the individual member’s sovereign currencies. This also explains why the idea of the new trade instrument being just a mix of all of these currencies was probably a bad idea.

This system would also have required endless reconfiguring as a growing procession of new members joined up. I view the 153 BRI members as a precursor to a massive watershed of new BRICS+ members adding exponentially to the size of this new bloc.

Incidentally, the SCO (Shanghai Cooperation Organisation) and BRICS+ are becoming more and more aligned too, with the SCO having nine full members, two observer nations, fourteen dialog members and another six pending applications, giving a grand total of 31 nations as members and associates. Kuwait, UAE, Maldives, Myanmar and Bahrain are all new dialog members just since May 2023

9. China is under no illusions about the serial economic hitman antics of the Western financial hegemon

They have witnessed the Latin American (LatAm) crises of the 1970s US orchestrated pump and dump schemes that effectively bankrupted their victim nations and allowed U$ corporations to pick up assets and public utilities for pennies on the pound.

Closer to home was the 1997 Asian Financial Crisis, which originated in Thailand with the collapse of the Thai baht and the capital flight after they were forced to float because of their lack of foreign currency to support the peg to the U$ dollar.

This spread quickly to many other southeast (SE) Asian countries and later to Japan and South Korea as well. The result was slumping currencies, stock markets, other asset prices, and a massive rise in debt with debt:GDP ratios rising by 100-180% in all of the largest economies.

China assisted in the damage control by making $4 billion available in bailout money, and by not devaluing its own currency. However the tide of capital fleeing these countries was not stopped and the authorities had to cease defending their exchange rates and allow their currencies to float. Their foreign liabilities grew massively in domestic currency terms, causing even more extended carnage.

The ASEAN countries believed that the well co-ordinated manipulation of their currencies was a deliberate attempt to destabilise their economies. The Malaysian Prime Minister, Mahathir Mohamad accused George Soros and other currency traders of ruining Malaysia’s economy with currency speculation.

Long story short, the carnage from this Western contrived pump and dump debacle was right on their doorstep and it remains very vivid in the minds of all of these SE Asian BRICS+ bloc members.

The NDB (New Development Bank) was tasked with helping to finance developing countries, and Russia in 2023 offered 25-50,000 tons of free grain to six struggling African nations.

In short it is obvious that China sees the real priority is to support Russia and the BRICS+ bloc, together in mutual cooperation in a 21st Century industrial revolution for the benefit of all member countries, their productive economies, and to build sustainable future wealth.

Halford Mackinder’s Heartland Theory: the Afro-Asian “World-Island” at permanent struggle with the Rimlands

10. Mackinder’s 1904 theory was right – the ‘World Island’ he predicted has indeed become a reality.

This could well be recorded for posterity as the major geopolitical pivot in the history of our species.

Now we await the announcement of the new hard backed trade instrument as soon as the BRICS+ nations are satisfied with their bullion stacking, and a non synthetic market driven price discovery for gold and silver takes place. IMO it will work admirably because a better alternative to the unbacked fiat countries will be, not only available, but utterly compelling for trade settlement purposes, but also in terms of stable and secure reserves.

The US is in an impossible debt trap now and the Fed has lost control – the cost of credit is too high for the massive amount of debt entrenched in the system and if the dollar weakens, inflation will be off to the races even further.

Official inflation figures are a complete croc anyway, and as John Williams reported 5 months ago for August 2023, when the official CPI was headlined at 3.7% YOY, his estimate was 11.5%. If the changes weren’t made to the calculation formula between the 80s and the early 2000s, they would be forced to report the double digit number.

When the inflation figure is manipulated to this degree it means that the Fed is in reality, operating outside of the price stability mandate. Given that employment figures are completely fictitious too, that many part time jobs are included in the total, and people no longer looking for jobs are excluded in the formula, this figure is a complete croc too.

To me this means that the 100% privately owned Fed is not operating within any effective mandate whatsoever, and even more outrageous is the fact it hasn’t had a proper audit for over 70 years!

11. Has the U$ and the West reached peak stupidity yet?

No, it seems they are still working on it – figures below are from…

To try to put the public debt into perspective I compared the US External National debt to the highest 30 debtor nations of the world. I took out the 17 of those that were NIIP positive (Net International Investment Position) – ie net external assets less liabilities, and at the current $34.34 trillion, this was more than double the debt of all the rest of the remaining 13 net indebted countries combined.

On present trends by 2031 every single penny of tax revenue will go just to pay interest on debt and spending on social security, which is already in a $70 trillion dollar hole.

Even more crazy is the fact that the U$ informed Saudi Arabia of its intention to transition into ‘green’ energy ASAP, when the KSA was the key lynchpin to saving the petrodollar, which was in turn the only possible saviour of U$ reserve currency status.

One of the common criticisms of BRICS+ bloc is its incredible diversity – I see this diversity as a strength, with each country bringing varying degrees of raw materials, energy resources, manufacturing prowess, and logistics, to the table, in a giant bloc that is no longer beholden to the West.

12. Overseas Investment in the US

Around $33 Trillion in total – made up of…

— $7.5T in short term investments – bank deposits, treasury bills, and corporate bills

— $14.5 is invested in equities and the balance in Treasury bonds

If the confidence in the U$ economy and its fiat currency starts to slide, will these foreigners stay in these investments if they have viable alternatives? Some of this $33T will obviously flee into gold. Some will go into China because with its massive infrastructural investments in Africa, Asia, and LatAm they will be seeking these capital inflows. Some of this capital will flow into entities stockpiling commodities, as this is a hedge against the fiat currencies’ declining purchasing power.

The West is hamstrung though, as it probably has at least 10,000 tons of gold with multiple ownership, as so much has been swapped and leased out.

Investing in real estate in countries where their currencies plummet can be problematic too. History showed that rents in Germany in the 1920s fell so much in real terms that a property could become a liability because maintenance and ownership costs could overtake income. This effect does not happen with money held in gold and silver. In a currency crisis this effect can become a deterrence to invest in some normally reasonably hard asset classes.

Conclusion

Clearly this monumental transition won’t be just about sound money and economic principles. This fix requires genuine statesman and the governance structures that have their citizens and nations egalitarian and long term interests at heart. This is evident within the RoW and BRICS+ governance and leaders, but is sadly lacking within in the Western train wreck.

Tragically it seems that the West will need to comprehensively crash and burn before the political appetite ousts the current treasonous bunch from office. Of course, there remains the danger during the transition period, of even more dangerous tyrants gaining power.

I predict an imminent watershed of U$ states seceding from the Union without radical changes in the behaviour of central government. So much for Uncle $laughter’s obsession with endeavouring to carve up the Russian Federation like a side of beef for the taking – the shoe could well end up on the other foot.

The BRICS+ bloc members don’t even need to interfere, as the West is doing far more to self-destruct than if all of their rivals combined together to deliberately try to undermine the hegemon.

I think the formal announcement of the new trade instrument will only eventuate when the BRICS+ bloc members have completed their bullion stacking, and as the new physical market discovery process begins in earnest.

The entire process to date amounts to a period of ~17 years or so. The new bloc has had all that time to carefully study historical models, and to design the new functional model accordingly.

Methinks they will get it right, especially since they hold a full hand of trump cards – including the left and right bowers, the Joker (Mr Putin) and enormous stacks of chips on the table as well.

Colin Maxwell

For GlobalSouth.co by our Col from New Zealand

Western eCONomists and the train wreck they cheerlead

If eCONomists took the time to read and understand the allegory within Baum’s book “The Wonderful Wizard of Oz”, then IMO they would learn more about fixing the broken Western financial system than from all of the current neo-classical textbook tripe combined.

So too, Ellen Brown’s epic book “The Web Of Debt” explains both the allegory and the connection to the most monumental theft of wealth in the history of our species. It seems that none of shills that the MSM promote have even made the connection.

I studied economics in the early 70’s and have had to spend the next 50 years unlearning what is essentially mythology.

All of the maxims are based on faulty models, including how money is created.

Modern-day neo-classical economics is a self-perpetuating myth – essentially it is nothing more than pseudo-science based on a giant hoax which allows money to be created as debt by the giant Western private banking cartel.

No wonder critical theory specialists, engineers, and even lawyers, can be better at understanding effective economic theory than us poor sods who were fed all this tripe at Uni.

99.9% of economists go along with this monumental con job simply because their jobs depend on them perpetuating these extraordinary myths.

Case in point – some snippets from a recent Washington Post (WaPo) article’s outrageous spin on the print fest:

“Since 2020, the United States has powered through a once-in-a-century pandemic, the highest inflation in 40 years and fallout from two foreign wars. Now, after posting faster annual growth last year than in 2022, the U.S. economy is quashing fears of a new recession while offering lessons for future crisis-fighting.

“The U.S. has really come out of this into a place of strength and is moving forward like covid never happened,” said Claudia Sahm, a former Federal Reserve economist who now runs an eponymous consulting firm. “We earned this; it wasn’t just a fluke.”

Washington’s success in reviving the economy also suggests a new approach to future downturns, one that relies more on the government’s power of the purse and less on the Federal Reserve’s control of the cost of credit.